The Volunteer Income Tax Assistance (VITA) program is an IRS-sponsored initiative that offers free tax preparation services to individuals and families earning $64,000 or less annually. The program operates through a network of community organizations, including nonprofit agencies, libraries, schools, and community centers, which host VITA sites during tax season. VITA volunteers complete IRS-certified training programs that cover federal tax law, ethics, and quality review procedures.

Volunteers must pass competency tests and receive annual recertification to maintain their qualifications. The program focuses on basic tax returns and specializes in helping taxpayers claim important credits such as the Earned Income Tax Credit (EITC), Child Tax Credit, and education credits. The program serves various populations, including low-to-moderate income workers, families with children, elderly taxpayers, persons with disabilities, and limited English-speaking taxpayers.

VITA sites typically prepare returns using IRS-approved software and provide electronic filing services. Many locations also offer basic financial counseling and information about asset-building programs such as Individual Development Accounts (IDAs) and matched savings programs. VITA operates alongside the Tax Counseling for the Elderly (TCE) program, which specifically serves taxpayers aged 60 and older.

Together, these programs prepare millions of tax returns annually and help eligible taxpayers claim billions of dollars in refunds and credits they might otherwise miss.

Key Takeaways

- VITA tax preparation offers free or low-cost tax help for eligible individuals.

- Finding local VITA sites is easy through online tools and community centers.

- Using local tax assistance ensures personalized support and helps boost community resources.

- Preparing documents and understanding your tax situation improves your VITA appointment experience.

- Avoid common filing errors and use VITA tips to maximize your tax refund efficiently.

Finding Vita Tax Preparation Near Me

Locating a VITA site in your vicinity is a straightforward process, thanks to the resources available through the IRS and local community organizations. The IRS maintains a comprehensive online directory where individuals can search for VITA locations based on their zip code. This tool allows users to find nearby sites that offer free tax preparation services, along with information about the hours of operation and any specific requirements for clients.

Additionally, many community centers, libraries, and nonprofit organizations partner with VITA to host tax preparation events, making it easier for individuals to access these essential services. In addition to online resources, local community boards and social service agencies often have information about VITA sites. Many of these organizations actively promote VITA services during tax season, recognizing the importance of providing accessible tax assistance to underserved populations.

By reaching out to local community centers or checking bulletin boards in public spaces, individuals can discover additional options for receiving help with their tax preparation needs.

Benefits of Using Local Tax Assistance

Utilizing local tax assistance services like VITA offers numerous advantages that extend beyond just the convenience of having a nearby location. One significant benefit is the personalized support that clients receive from volunteers who understand the unique financial challenges faced by their community members. These volunteers often share similar backgrounds and experiences, which fosters a sense of trust and understanding between them and the clients they serve.

This rapport can lead to more effective communication and a better overall experience during the tax preparation process. Moreover, local tax assistance programs often provide additional resources beyond just tax preparation. Many VITA sites offer financial education workshops, helping clients understand budgeting, saving, and other essential financial skills.

This holistic approach not only addresses immediate tax concerns but also equips individuals with the knowledge they need to make informed financial decisions in the future. By engaging with local tax assistance programs, clients can build a stronger foundation for their financial well-being.

What to Expect from Vita Tax Preparation Services

When visiting a VITA site for tax preparation, clients can expect a welcoming environment where they will be greeted by trained volunteers ready to assist them. The process typically begins with an intake interview, during which volunteers gather essential information about the client’s financial situation, including income sources, family size, and any potential deductions or credits they may qualify for. This initial assessment is crucial for ensuring that all relevant information is considered when preparing the tax return.

Once the intake process is complete, volunteers will work diligently to prepare the client’s tax return using IRS-approved software. Clients can expect transparency throughout this process; volunteers will explain each step and answer any questions that arise. After the return is prepared, clients will have the opportunity to review it carefully before it is submitted electronically to the IRS.

This collaborative approach not only helps ensure accuracy but also empowers clients by involving them in the decision-making process regarding their taxes.

How to Prepare for Your Vita Tax Appointment

| Location | Service Availability | Operating Hours | Appointment Required | Contact Number | Additional Notes |

|---|---|---|---|---|---|

| Downtown Community Center | VITA Tax Preparation | Mon-Fri 9 AM – 5 PM | Yes | (555) 123-4567 | Free electronic filing available |

| Westside Public Library | VITA Tax Preparation | Tue & Thu 10 AM – 4 PM | No | (555) 234-5678 | Walk-ins welcome, limited slots |

| Eastside Senior Center | VITA Tax Preparation | Wed 12 PM – 6 PM | Yes | (555) 345-6789 | Priority for seniors and disabled |

| Northside Community Hall | VITA Tax Preparation | Sat 9 AM – 3 PM | No | (555) 456-7890 | First come, first served basis |

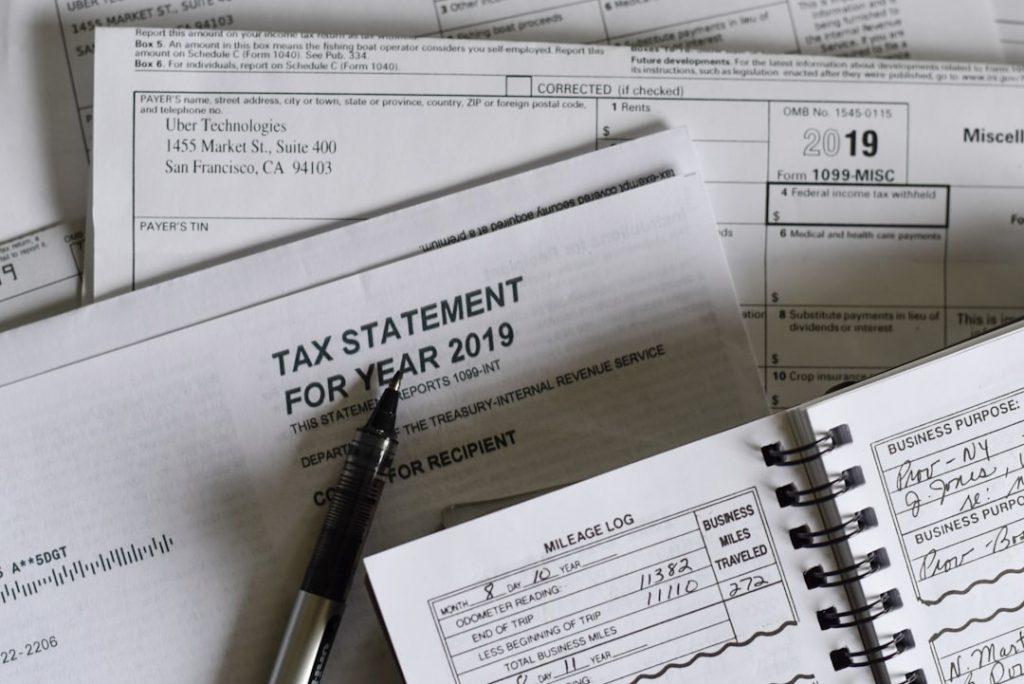

Preparing for a VITA appointment can significantly enhance the efficiency of the tax preparation process. Clients should gather all necessary documentation before their appointment to ensure that volunteers have everything they need to accurately prepare their returns. Essential documents include W-2 forms from employers, 1099 forms for any freelance or contract work, proof of any other income sources, and documentation related to deductions or credits, such as receipts for medical expenses or educational costs.

In addition to financial documents, clients should also bring identification and Social Security cards for themselves and any dependents they plan to claim on their taxes. Having this information readily available will streamline the appointment and help volunteers complete the return more quickly. Furthermore, clients should come prepared with any questions they may have about their taxes or potential deductions; this proactive approach can lead to a more informative and beneficial experience during the appointment.

Common Mistakes to Avoid When Filing Taxes

Filing taxes can be a daunting task, and even small mistakes can lead to significant consequences, including delays in processing refunds or potential audits by the IRS. One common error is failing to report all sources of income accurately. Many individuals may overlook freelance work or side jobs that generate income but do not come with a W-2 form.

It is crucial for taxpayers to keep thorough records of all income received throughout the year to avoid discrepancies when filing. Another frequent mistake involves overlooking available deductions or credits that could significantly reduce tax liability or increase refunds. For instance, many eligible taxpayers fail to claim the Earned Income Tax Credit (EITC) simply because they are unaware of its existence or do not understand how it applies to their situation.

Engaging with VITA volunteers can help mitigate these risks, as they are trained to identify potential deductions and credits that clients may qualify for based on their unique circumstances.

Tips for Maximizing Your Tax Refund with Vita Tax Preparation

To maximize tax refunds while utilizing VITA services, clients should take advantage of all available credits and deductions applicable to their financial situation. One effective strategy is to ensure that all eligible dependents are claimed on the tax return. This includes children as well as qualifying relatives who may live with the taxpayer and meet specific criteria set by the IRS.

Claiming dependents can lead to substantial credits that directly increase refund amounts. Additionally, clients should inquire about various deductions related to education expenses, medical costs, and even certain work-related expenses that may be deductible. For example, if a taxpayer has incurred costs related to job searches or continuing education, these expenses may be deductible if they meet IRS guidelines.

By discussing these possibilities with VITA volunteers during the appointment, clients can uncover opportunities that may significantly enhance their overall refund.

The Importance of Local Community Support for Tax Assistance

The role of local community support in facilitating access to tax assistance cannot be overstated. Community organizations often serve as vital conduits between taxpayers and resources like VITA programs. By promoting awareness of available services through outreach efforts such as workshops, informational sessions, and social media campaigns, these organizations help ensure that individuals who need assistance are aware of their options.

Moreover, local support networks foster collaboration among various stakeholders involved in tax assistance efforts. Partnerships between nonprofits, government agencies, and educational institutions can lead to more comprehensive services that address not only tax preparation but also broader financial literacy initiatives. This collaborative approach strengthens community ties and empowers residents by equipping them with essential knowledge and resources needed for effective financial management throughout the year.

In summary, understanding VITA tax preparation services is crucial for individuals seeking assistance with their taxes. By finding local resources, preparing adequately for appointments, avoiding common mistakes, and maximizing potential refunds through informed discussions with volunteers, taxpayers can navigate the complexities of filing taxes more effectively. The support provided by local communities enhances these efforts further by ensuring that essential resources are accessible to those who need them most.