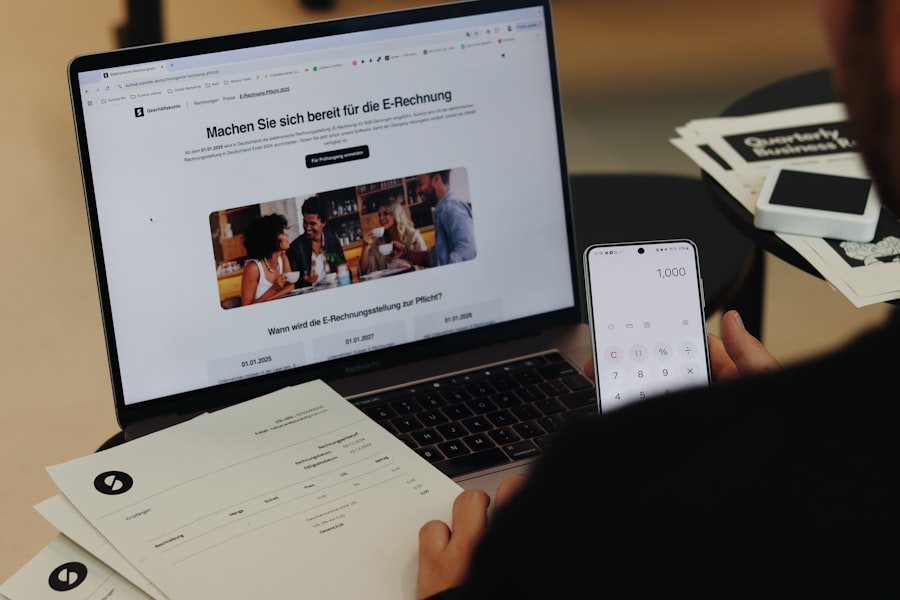

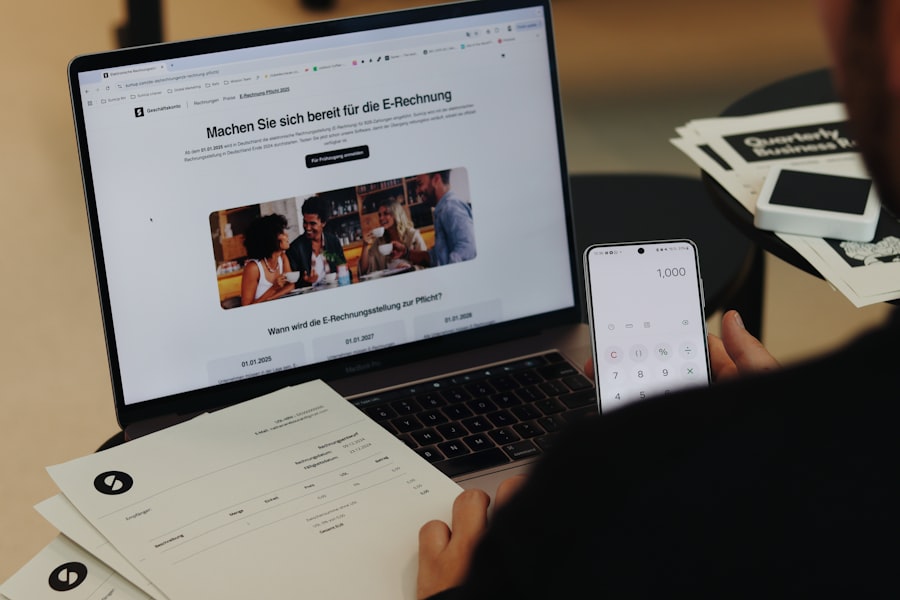

In the digital age, businesses are increasingly adopting online invoice software to optimize their billing operations. This technology delivers substantial efficiency improvements to invoicing processes. Traditional invoicing methods typically require manual data entry, physical paper documents, and extended approval workflows, resulting in processing delays and increased error rates.

Online invoice software automates these functions, enabling businesses to generate and distribute invoices rapidly with enhanced accuracy. This automation reduces processing time and minimizes human error, ensuring timely and precise invoice delivery. Online invoice software provides superior accessibility compared to conventional invoicing systems.

Traditional methods often depend on physical document storage or locally-installed software, while cloud-based solutions enable access from any location with internet connectivity. This accessibility particularly benefits organizations with distributed workforces or multi-location operations. Many online invoicing platforms include mobile applications that allow invoice creation and management from mobile devices.

This comprehensive accessibility enables businesses to respond promptly to client requirements, improving customer satisfaction and strengthening business relationships.

Key Takeaways

- Online invoice software enhances billing efficiency and accuracy for businesses.

- Choosing the right software depends on features, ease of use, and integration capabilities.

- Automation in invoicing reduces manual errors and saves time.

- Integration with accounting systems streamlines financial management.

- Online invoicing improves cash flow by facilitating faster client payments.

How to Choose the Right Online Invoice Software for Your Business

Selecting the appropriate online invoice software for your business requires careful consideration of several factors. First and foremost, it is essential to assess your specific invoicing needs. Different businesses have varying requirements based on their size, industry, and billing practices.

For instance, a freelance graphic designer may need a simple invoicing tool with customizable templates, while a larger company might require more advanced features such as recurring billing, multi-currency support, or integration with other financial systems. Understanding your unique needs will help narrow down your options. Another critical aspect to consider is the user interface and overall ease of use.

A complex or unintuitive platform can lead to frustration and inefficiency. It is advisable to look for software that offers a clean, user-friendly interface that allows for easy navigation and quick invoice creation. Many providers offer free trials or demos, which can be invaluable in assessing whether the software meets your expectations.

Additionally, consider the level of customer support provided by the software vendor. Reliable customer service can be a lifesaver when technical issues arise or when you need assistance with specific features.

Streamlining Your Billing Process with Online Invoice Software

The implementation of online invoice software can significantly streamline the billing process for businesses of all sizes. By automating repetitive tasks such as invoice generation and delivery, companies can reduce the time spent on administrative duties. For example, instead of manually creating invoices for each client, users can set up templates that automatically populate with client information and service details.

This not only speeds up the invoicing process but also ensures consistency across all invoices sent out. Moreover, online invoice software often includes features that facilitate better organization and tracking of invoices. Many platforms allow users to categorize invoices by client, project, or status (e.g., paid, pending, overdue).

This level of organization makes it easier for businesses to monitor their accounts receivable and follow up on outstanding payments. Additionally, some software solutions provide reporting tools that offer insights into billing trends and cash flow, enabling businesses to make informed financial decisions based on real-time data.

Automating Your Invoicing with Online Invoice Software

Automation is one of the standout features of online invoice software that can transform how businesses handle their billing processes. By automating invoicing tasks, companies can minimize manual input and reduce the risk of errors associated with human oversight. For instance, many online invoicing platforms allow users to set up recurring invoices for clients who require regular billing, such as subscription services or ongoing projects.

This feature not only saves time but also ensures that businesses receive payments consistently without having to remember to send invoices each month. In addition to recurring billing, automation can extend to payment reminders and follow-ups. Many online invoice solutions come equipped with automated reminder systems that notify clients when payments are due or overdue.

This proactive approach helps maintain cash flow and reduces the need for businesses to chase down payments manually. Furthermore, some platforms integrate with payment gateways, allowing clients to pay directly through the invoice via credit card or other electronic methods. This seamless payment process enhances the customer experience while ensuring that businesses receive their funds more quickly.

Integrating Online Invoice Software with Your Accounting System

| Metric | Value | Description |

|---|---|---|

| Average Invoice Processing Time | 2 minutes | Time taken to create and send an invoice using the software |

| Payment Integration Options | 10+ | Number of payment gateways supported for receiving payments |

| Automation Features | Recurring Invoices, Auto Reminders | Key automation capabilities to streamline invoicing |

| Mobile App Availability | Yes | Availability of mobile applications for invoicing on the go |

| Multi-Currency Support | 50+ | Number of currencies supported for international invoicing |

| Customer Support | 24/7 Live Chat & Email | Support options available for users |

| Average User Rating | 4.5 / 5 | Average rating from user reviews on software platforms |

| Free Trial Period | 14 days | Duration of free trial offered to new users |

Integrating online invoice software with existing accounting systems is a crucial step for businesses looking to enhance their financial management processes. When invoicing software is connected to accounting platforms, it creates a cohesive ecosystem where data flows seamlessly between systems. This integration eliminates the need for double data entry, reducing the risk of discrepancies between invoices and financial records.

For example, when an invoice is marked as paid in the invoicing software, it automatically updates the corresponding entry in the accounting system. Moreover, integration allows for better financial reporting and analysis. With all financial data centralized in one place, businesses can generate comprehensive reports that provide insights into revenue trends, outstanding invoices, and overall financial health.

This holistic view enables business owners to make informed decisions based on accurate data rather than relying on fragmented information from multiple sources. Additionally, many online invoice solutions offer integration capabilities with popular accounting software such as QuickBooks or Xero, making it easier for businesses to find a solution that fits their existing workflows.

Managing Client Payments and Invoices with Online Invoice Software

Effective management of client payments and invoices is essential for maintaining healthy cash flow within a business. Online invoice software provides tools that simplify this process significantly. Users can easily track which invoices have been sent, which are outstanding, and which have been paid—all from a centralized dashboard.

This visibility allows businesses to stay on top of their accounts receivable and take timely action when necessary. Furthermore, many online invoicing platforms offer features that enhance communication with clients regarding payments. For instance, businesses can send personalized payment reminders or follow-up messages directly through the software.

Some platforms even allow clients to leave comments or notes on invoices, facilitating better communication regarding any discrepancies or questions about charges. By fostering open lines of communication and providing clients with easy access to their payment history, businesses can build stronger relationships and encourage timely payments.

Improving Cash Flow with Online Invoice Software

Cash flow is the lifeblood of any business, and online invoice software plays a pivotal role in improving it. By streamlining invoicing processes and automating payment reminders, businesses can reduce the time it takes to receive payments from clients. Faster invoicing means that funds are available sooner for operational expenses or reinvestment into the business.

For example, a small consulting firm that implements online invoicing may find that they receive payments within days rather than weeks due to improved efficiency in their billing process. Additionally, many online invoice solutions provide insights into cash flow trends through reporting features. Businesses can analyze their invoicing patterns over time to identify peak periods for revenue generation or potential cash flow gaps during slower months.

Armed with this information, business owners can make strategic decisions about budgeting, resource allocation, and even pricing strategies to optimize their cash flow management.

The Future of Billing: Online Invoice Software and Beyond

As technology continues to evolve, so too does the landscape of billing and invoicing solutions. The future of online invoice software is likely to be shaped by advancements in artificial intelligence (AI) and machine learning (ML). These technologies have the potential to further automate invoicing processes by predicting payment behaviors based on historical data or even suggesting optimal payment terms tailored to individual clients’ preferences.

Moreover, as businesses increasingly embrace digital transformation, we may see a rise in blockchain technology’s application within invoicing systems. Blockchain could provide enhanced security and transparency in transactions by creating immutable records of invoices and payments. This would not only reduce fraud but also streamline audits and compliance processes for businesses operating in regulated industries.

In conclusion, online invoice software represents a significant advancement in how businesses manage their billing processes. With its myriad benefits—from increased efficiency and accessibility to improved cash flow management—this technology is poised to play an integral role in shaping the future of financial operations across various industries. As companies continue to adapt to changing market demands and technological innovations, embracing online invoicing solutions will be essential for staying competitive in an increasingly digital world.