SAP Accounting Software is a robust financial management tool designed to cater to the diverse needs of businesses, ranging from small enterprises to large corporations. One of its primary capabilities is its comprehensive financial reporting functionality, which allows organizations to generate detailed reports on their financial health. This includes balance sheets, income statements, and cash flow statements, all of which can be customized to meet specific business requirements.

The software also supports multi-currency transactions, enabling companies to operate seamlessly in a global marketplace. This feature is particularly beneficial for businesses that engage in international trade, as it simplifies the complexities associated with currency conversion and exchange rate fluctuations. In addition to financial reporting, SAP Accounting Software offers advanced budgeting and forecasting tools.

These tools empower organizations to create accurate financial projections based on historical data and current market trends. By utilizing predictive analytics, businesses can make informed decisions regarding resource allocation and investment strategies. Furthermore, the software integrates with other SAP modules, such as SAP ERP and SAP Business One, providing a holistic view of the organization’s financial landscape.

This integration ensures that all financial data is synchronized across departments, enhancing overall operational efficiency and decision-making processes.

Key Takeaways

- SAP Accounting Software offers comprehensive tools for financial management and reporting.

- Best practices in data entry ensure accuracy and reliability of financial data.

- Automation features help reduce manual effort and increase efficiency in accounting tasks.

- Integration with other business systems enables seamless data flow and improved operational coherence.

- Employee training is essential to fully leverage SAP’s capabilities and optimize accounting processes.

Implementing best practices for data entry and management

Effective data entry and management are critical components of successful accounting practices within SAP Accounting Software. One of the best practices involves establishing standardized procedures for data entry to minimize errors and inconsistencies. This can include creating templates for common transactions, such as invoices and expense reports, which guide users through the necessary fields and reduce the likelihood of missing information.

Additionally, implementing validation rules within the software can help ensure that only accurate and relevant data is entered into the system. For instance, setting up mandatory fields for essential information can prevent incomplete entries that could lead to discrepancies in financial reporting. Another important aspect of data management is regular data cleansing and maintenance.

Over time, databases can accumulate outdated or duplicate records that can skew financial analysis and reporting. Organizations should schedule routine audits of their data to identify and rectify these issues. Utilizing SAP’s built-in tools for data analysis can assist in this process by highlighting anomalies or inconsistencies in financial records.

Furthermore, training employees on the importance of accurate data entry and management fosters a culture of accountability and diligence, ensuring that all team members understand their role in maintaining the integrity of financial information.

Streamlining financial reporting processes with SAP Accounting Software

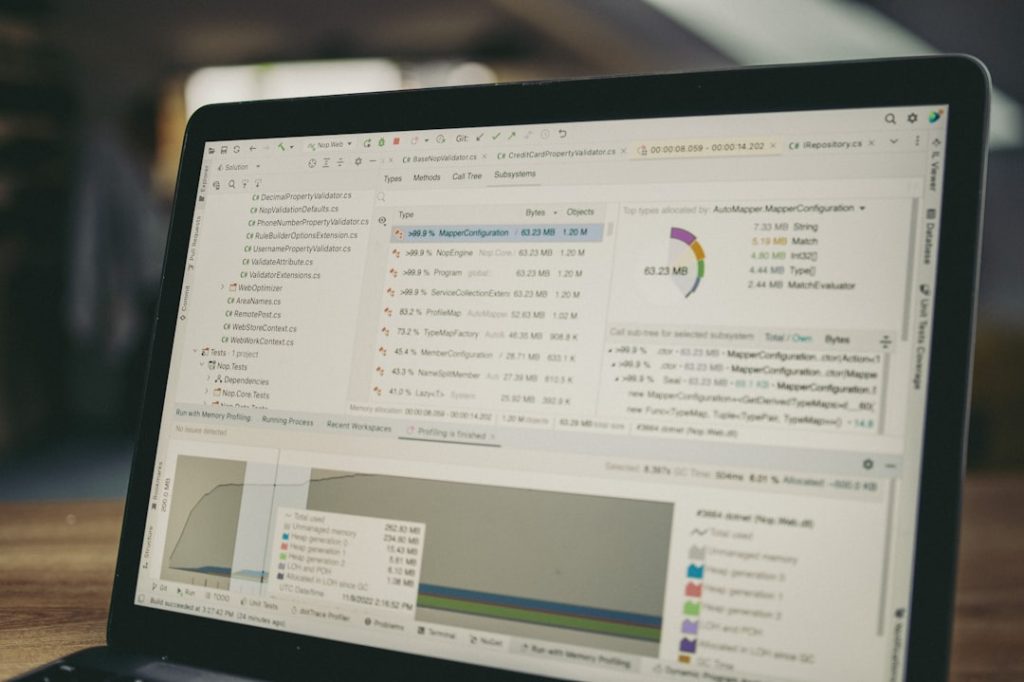

The financial reporting capabilities of SAP Accounting Software are designed to streamline the reporting process significantly. One way this is achieved is through automated report generation, which allows users to create reports with just a few clicks. By leveraging predefined templates and customizable parameters, organizations can quickly generate reports that meet their specific needs without having to manually compile data from various sources.

This not only saves time but also reduces the risk of human error that often accompanies manual reporting processes. Moreover, SAP Accounting Software facilitates real-time reporting, enabling businesses to access up-to-date financial information at any moment. This feature is particularly advantageous for decision-makers who require timely insights to guide their strategic planning.

The software’s dashboard functionality provides a visual representation of key performance indicators (KPIs), allowing users to monitor financial performance at a glance. By integrating these real-time insights into regular business reviews, organizations can make proactive adjustments to their financial strategies, ensuring they remain agile in a dynamic market environment.

Leveraging automation features for repetitive accounting tasks

Automation is one of the standout features of SAP Accounting Software, designed to alleviate the burden of repetitive accounting tasks that can consume valuable time and resources. For instance, invoice processing can be automated through the use of optical character recognition (OCR) technology, which scans and extracts relevant information from paper invoices. This automation not only speeds up the processing time but also minimizes errors associated with manual data entry.

Once invoices are digitized, they can be automatically matched against purchase orders and receipts, streamlining the accounts payable process. Additionally, recurring transactions such as monthly subscriptions or payroll can be set up within the software to occur automatically at specified intervals. This feature ensures that payments are made on time without requiring manual intervention each month.

By automating these routine tasks, accounting teams can redirect their focus toward more strategic activities such as financial analysis and planning. Furthermore, automation enhances compliance by ensuring that all transactions are recorded consistently and accurately, reducing the risk of discrepancies during audits.

Integrating SAP Accounting Software with other business systems for seamless data flow

| Metric | Description | Value / Range | Notes |

|---|---|---|---|

| Deployment Options | Available deployment methods for SAP Accounting Software | Cloud, On-Premise, Hybrid | Flexible deployment to suit business needs |

| Supported Accounting Standards | Accounting frameworks supported by SAP | GAAP, IFRS, Local GAAPs | Supports global compliance requirements |

| Integration Capabilities | Ability to integrate with other systems | ERP, CRM, Payroll, Banking APIs | Seamless data flow across business functions |

| Automation Features | Automated processes within accounting | Invoice processing, Payment reconciliation, Tax calculation | Reduces manual errors and processing time |

| Reporting & Analytics | Financial reporting and data analysis tools | Real-time dashboards, Custom reports, Predictive analytics | Supports strategic decision making |

| User Base | Typical number of users in organizations | Small to Large Enterprises (10 to 10,000+ users) | Scalable for different business sizes |

| Implementation Time | Average time to deploy SAP Accounting Software | 3 to 12 months | Depends on company size and customization |

| Compliance & Security | Security standards and compliance certifications | ISO 27001, GDPR, SOX Compliance | Ensures data protection and regulatory adherence |

| Cost Structure | Pricing model for SAP Accounting Software | Subscription-based, Perpetual license | Varies by deployment and user count |

Integration is a crucial aspect of maximizing the effectiveness of SAP Accounting Software within an organization. By connecting it with other business systems—such as customer relationship management (CRM), supply chain management (SCM), and human resources (HR)—companies can achieve a seamless flow of data across departments. For example, integrating SAP Accounting Software with a CRM system allows sales teams to access real-time financial information related to customer accounts, enabling them to make informed decisions regarding credit limits and payment terms.

Moreover, this integration facilitates better collaboration between departments by ensuring that all teams have access to consistent and accurate data. For instance, when inventory levels are updated in the SCM system, this information can automatically reflect in the accounting software, allowing finance teams to adjust their forecasts accordingly. This interconnectedness not only enhances operational efficiency but also improves overall decision-making by providing a comprehensive view of the organization’s performance across various functions.

Optimizing cash flow management and forecasting with SAP Accounting Software

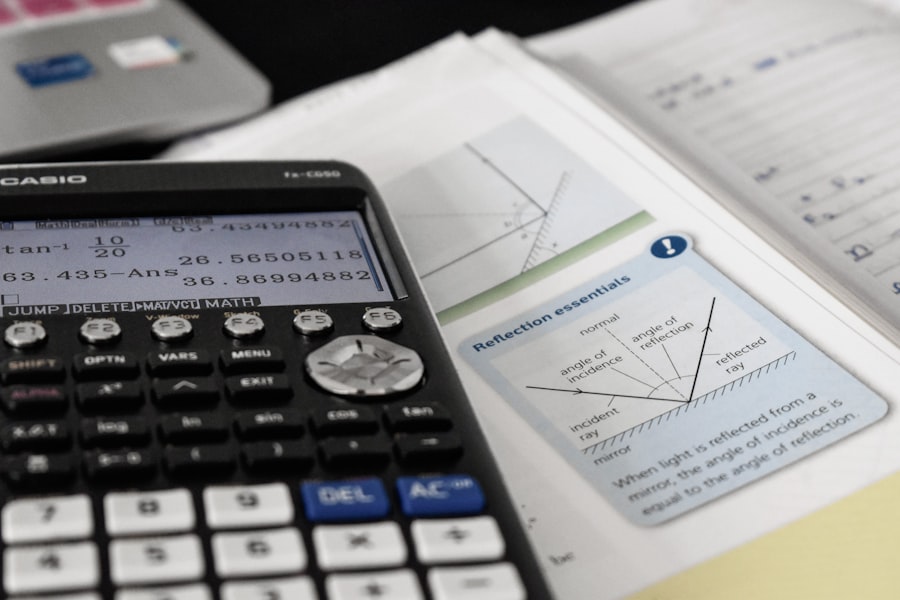

Effective cash flow management is vital for any business’s sustainability and growth, and SAP Accounting Software offers several tools to optimize this process. One key feature is cash flow forecasting, which utilizes historical data and predictive analytics to project future cash inflows and outflows. By analyzing past trends in revenue and expenses, organizations can anticipate potential cash shortages or surpluses, allowing them to make informed decisions about investments or cost-cutting measures.

Additionally, the software provides insights into accounts receivable and payable aging reports, enabling businesses to identify overdue invoices and manage payment schedules effectively. By monitoring these metrics closely, organizations can implement strategies to accelerate collections from customers while ensuring timely payments to suppliers. This proactive approach not only enhances cash flow but also strengthens relationships with stakeholders by demonstrating reliability in financial dealings.

Enhancing compliance and audit readiness with SAP Accounting Software

Compliance with regulatory standards is a critical concern for businesses operating in today’s complex financial landscape. SAP Accounting Software is equipped with features designed to enhance compliance and audit readiness by maintaining accurate records and facilitating transparent reporting practices. The software adheres to various accounting standards such as GAAP or IFRS, ensuring that financial statements are prepared in accordance with legal requirements.

Furthermore, audit trails are automatically generated within the system, documenting every transaction made within the software. This feature provides auditors with a clear record of all financial activities, simplifying the audit process significantly. Organizations can also utilize built-in compliance checks that flag potential issues before they escalate into significant problems.

By fostering a culture of compliance through regular training and updates on regulatory changes, businesses can mitigate risks associated with non-compliance while enhancing their overall credibility in the marketplace.

Training and upskilling employees to maximize efficiency with SAP Accounting Software

To fully leverage the capabilities of SAP Accounting Software, organizations must invest in training and upskilling their employees. Comprehensive training programs should be developed to ensure that all users are proficient in navigating the software’s features and functionalities. This includes hands-on workshops that allow employees to practice real-world scenarios within a controlled environment.

By familiarizing staff with the software’s capabilities—from basic data entry to advanced reporting—organizations can enhance overall productivity and reduce reliance on external consultants. Moreover, ongoing education is essential in keeping employees updated on new features or updates released by SAP. As technology evolves rapidly, continuous learning opportunities such as webinars or online courses can help employees stay ahead of industry trends and best practices.

Encouraging a culture of learning not only boosts employee morale but also fosters innovation within the organization as team members feel empowered to explore new ways to utilize the software effectively. By prioritizing training initiatives, businesses can maximize their investment in SAP Accounting Software while ensuring that their workforce remains agile and adaptable in an ever-changing business environment.