Understanding tax deductions is important for individuals and businesses seeking to reduce their tax liability. Tax deductions are expenses that the Internal Revenue Service (IRS) permits taxpayers to subtract from their gross income, which lowers their taxable income and potentially reduces the amount of tax owed. Standard deductions available to taxpayers include mortgage interest, state and local taxes (subject to limitations), qualifying medical expenses, and charitable contributions to eligible organizations.

Taxpayers who itemize deductions can claim mortgage interest paid on qualified home loans, which often provides substantial tax benefits for homeowners. The IRS publishes annual guidelines detailing eligible deductions, and these rules may change each tax year. Self-employed individuals and business owners have access to additional deduction categories.

Legitimate business expenses such as office supplies, business travel, equipment, and professional services are generally deductible. The home office deduction applies when a portion of a residence is used regularly and exclusively for business purposes. Taxpayers can calculate this deduction using either the simplified method (a standard rate per square foot) or the actual expense method (based on the percentage of home expenses attributable to business use).

Proper documentation and adherence to IRS guidelines are essential for claiming these deductions while maintaining compliance with tax regulations.

Key Takeaways

- Identify and maximize all eligible deductions to reduce taxable income.

- Maintain precise and organized records to support your tax claims.

- Use tax-advantaged accounts like IRAs and HSAs to save on taxes.

- Leverage available tax credits to directly lower your tax bill.

- Consider timing income and expenses strategically to optimize tax outcomes.

Keeping Accurate Records

Accurate record-keeping is the backbone of effective tax management. The IRS requires taxpayers to maintain documentation that supports their income and deductions. This includes receipts, invoices, bank statements, and any other relevant financial documents.

For instance, if you claim a deduction for business expenses, having detailed records of those expenses is essential in case of an audit. A well-organized filing system can save you time and stress during tax season. Digital tools and apps can assist in tracking expenses and storing receipts electronically, making it easier to retrieve information when needed.

In addition to supporting deductions, accurate records can also help in identifying trends in your financial situation over time. By analyzing your income and expenses year over year, you can make informed decisions about budgeting and spending. For example, if you notice a consistent increase in certain expenses, such as utilities or supplies, you may want to investigate ways to reduce those costs.

Furthermore, maintaining accurate records can facilitate smoother interactions with tax professionals or financial advisors, as they will have access to comprehensive data that reflects your financial history.

Utilizing Tax-Advantaged Accounts

Tax-advantaged accounts are powerful tools that can help individuals and businesses reduce their taxable income while saving for future needs. These accounts include options like Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), and retirement accounts such as 401(k)s and IRAs. Contributions to these accounts often come with tax benefits; for instance, contributions to a traditional IRA may be tax-deductible, reducing your taxable income for the year in which you contribute.

This not only helps in immediate tax savings but also encourages long-term savings for retirement. Health Savings Accounts are particularly noteworthy as they offer a triple tax advantage: contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free. This makes HSAs an excellent option for those with high-deductible health plans who want to save for future medical costs while enjoying tax benefits today.

Additionally, utilizing employer-sponsored retirement plans can further enhance your savings strategy. Many employers offer matching contributions to 401(k) plans, which is essentially free money that can significantly boost your retirement savings over time.

Taking Advantage of Tax Credits

Tax credits are often more beneficial than deductions because they directly reduce the amount of tax owed rather than just lowering taxable income. There are various types of tax credits available, including those for education expenses, energy-efficient home improvements, and child care costs. For example, the American Opportunity Tax Credit allows eligible students to claim up to $2,500 per year for qualified education expenses during their first four years of higher education.

This credit can significantly alleviate the financial burden of college tuition and related costs. Another notable credit is the Earned Income Tax Credit (EITC), which is designed to benefit low- to moderate-income working individuals and families. The EITC can provide a substantial refund even if no taxes were owed during the year.

Eligibility for this credit depends on several factors, including income level and number of qualifying children. By understanding and leveraging these credits, taxpayers can maximize their refunds or reduce their tax liabilities significantly. It is essential to stay informed about available credits each tax year as they can change based on new legislation or adjustments in eligibility criteria.

Timing Your Income and Expenses

| Metric | Description | Example Value | Unit |

|---|---|---|---|

| Claim Amount | The total amount of tax being claimed for refund or adjustment | 1500 | Currency Units |

| Filing Date | The date on which the tax claim was submitted | 2024-05-15 | Date |

| Claim Status | Current status of the tax claim | Pending | Text |

| Processing Time | Average time taken to process a tax claim | 30 | Days |

| Approved Amount | Amount approved for refund after claim review | 1200 | Currency Units |

| Rejected Amount | Amount rejected or disallowed in the claim | 300 | Currency Units |

| Number of Claims Filed | Total number of tax claims filed in a given period | 5000 | Count |

| Average Claim Value | Average amount claimed per tax claim | 1000 | Currency Units |

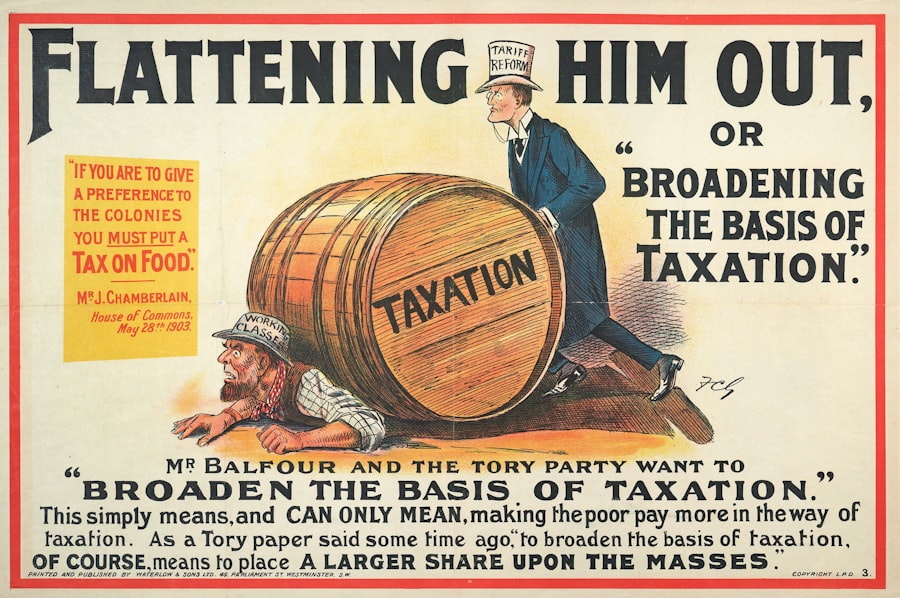

The timing of income recognition and expense deduction can have a profound impact on your overall tax liability. Taxpayers often have some flexibility regarding when they receive income or incur expenses, which can be strategically managed to optimize tax outcomes. For instance, if you anticipate being in a lower tax bracket next year due to a decrease in income or other factors, it may be advantageous to defer income until the following year while accelerating deductible expenses into the current year.

This strategy could result in a lower overall tax bill. Conversely, if you expect an increase in income that would push you into a higher tax bracket next year, it might be wise to accelerate income into the current year while deferring expenses where possible. For example, if you run a business and have clients who are willing to pay invoices early, collecting those payments before year-end could help you take advantage of your current lower tax rate.

Similarly, delaying large purchases or deductible expenses until the next tax year could provide additional tax relief when you anticipate being in a higher bracket.

Seeking Professional Help

While many individuals attempt to navigate their taxes independently, enlisting the help of a tax professional can provide invaluable insights and expertise that may lead to greater savings. Tax professionals are well-versed in the complexities of tax law and can help identify deductions and credits that taxpayers might overlook. They can also provide guidance on how to structure finances in a way that minimizes tax liability while ensuring compliance with IRS regulations.

Moreover, tax professionals can assist with more complex situations such as business ownership or investment income. They can help strategize around issues like estimated tax payments or capital gains taxes that may arise from selling investments. In addition to preparing returns accurately and efficiently, they can also represent clients in case of audits or disputes with the IRS.

The investment in professional help often pays off through increased refunds or reduced liabilities that far exceed the cost of their services.

Staying Informed About Tax Law Changes

Tax laws are subject to frequent changes due to new legislation or shifts in government policy. Staying informed about these changes is crucial for effective tax planning and compliance. For instance, recent changes under the Tax Cuts and Jobs Act introduced significant alterations to individual and corporate tax rates, as well as modifications to itemized deductions and credits available to taxpayers.

Understanding these changes allows individuals and businesses to adjust their strategies accordingly. Additionally, resources such as IRS publications, reputable financial news outlets, and professional organizations provide updates on tax law changes that could impact taxpayers’ situations. Subscribing to newsletters or following relevant social media channels can also keep you informed about important deadlines and new opportunities for savings.

Engaging with community workshops or webinars hosted by financial experts can further enhance your understanding of how these changes affect your specific circumstances.

Filing Electronically for Faster Processing

Filing taxes electronically has become increasingly popular due to its convenience and efficiency compared to traditional paper filing methods. Electronic filing (e-filing) allows taxpayers to submit their returns directly through authorized software or through a tax professional’s platform. One of the primary advantages of e-filing is the speed at which returns are processed; many e-filed returns receive refunds within a few weeks compared to paper returns that may take several months.

Additionally, e-filing reduces the likelihood of errors since many software programs include built-in checks that help identify potential mistakes before submission. This feature is particularly beneficial for complex returns where calculations may be prone to human error. Furthermore, e-filing provides immediate confirmation that your return has been received by the IRS, offering peace of mind that paper filers do not receive until their return is processed.

With advancements in technology and increased security measures surrounding electronic submissions, e-filing has become an efficient option for taxpayers looking to streamline their filing process while ensuring accuracy and timeliness in their submissions.