Technology has transformed tax preparation through online platforms that provide several practical advantages for individual taxpayers and small business owners. Online tax preparation eliminates the need for scheduled appointments with tax professionals, allowing users to complete their returns from any location with internet access. This approach enables taxpayers to work on their returns according to their preferred schedule, including evenings and weekends.

Most online tax platforms feature intuitive interfaces with guided workflows that break down tax procedures into manageable steps and provide explanations for complex tax regulations. Online tax preparation typically costs significantly less than traditional professional services, particularly for taxpayers with uncomplicated financial situations. Many platforms offer free filing options for basic tax returns, while paid versions remain substantially cheaper than hiring a tax professional.

This pricing structure makes tax preparation accessible to a wider range of taxpayers. Online platforms include automated calculation functions and built-in error detection systems that identify potential mistakes before submission, reducing the likelihood of filing errors that could result in penalties or delays in processing.

Key Takeaways

- Online tax preparation offers convenience, accuracy, and time savings.

- Selecting the right software depends on your tax complexity and budget.

- Online tools help identify and maximize eligible deductions and credits.

- Avoid common errors by double-checking entries and using software guidance.

- Small business owners can benefit from specialized features in online tax platforms.

Choosing the Right Online Tax Preparation Software

Selecting the appropriate online tax preparation software is crucial for a smooth filing experience. With numerous options available, it’s essential to consider several factors before making a decision. First and foremost, assess your specific tax situation.

Some software is tailored for simple individual returns, while others cater to more complex scenarios involving investments, rental properties, or self-employment income. For instance, platforms like TurboTax and H&R Block offer various tiers of service that accommodate different levels of complexity, ensuring that users can find a solution that meets their needs. Another important consideration is the level of customer support provided by the software.

While many online tax preparation tools are designed to be intuitive, having access to reliable customer service can be invaluable, especially if you encounter issues or have questions during the filing process. Look for software that offers multiple support channels, such as live chat, phone support, or comprehensive FAQs. Additionally, reading user reviews can provide insights into the experiences of others and help you gauge the reliability and effectiveness of the software you are considering.

Maximizing Deductions and Credits with Online Tax Prep

One of the most significant advantages of using online tax preparation software is its ability to help users identify and maximize deductions and credits. Many platforms come equipped with built-in tools that prompt users to input information related to potential deductions, such as medical expenses, mortgage interest, and charitable contributions. For example, if you have made donations to qualifying organizations throughout the year, the software will typically ask about these contributions and guide you through the process of documenting them properly.

Moreover, online tax preparation tools often include features that help users stay updated on current tax laws and changes that may affect their eligibility for various credits. For instance, the Child Tax Credit has undergone several modifications in recent years, and software like TaxAct or FreeTaxUSA can provide real-time updates on these changes. By leveraging these resources, taxpayers can ensure they are not leaving money on the table and are taking full advantage of available tax benefits.

Avoiding Common Mistakes with Online Tax Preparation

While online tax preparation offers numerous benefits, it is not without its pitfalls. One common mistake that many taxpayers make is rushing through the process without thoroughly reviewing their entries. This haste can lead to errors in personal information, income reporting, or deduction claims.

For instance, failing to report all sources of income can trigger an audit or result in penalties from the IRS. To mitigate this risk, it is advisable to take your time during the filing process and double-check all entries before submission. Another frequent error involves overlooking state-specific requirements.

Many taxpayers focus solely on federal returns and neglect to consider their state tax obligations. Each state has its own set of rules and regulations regarding deductions and credits, which can differ significantly from federal guidelines. Online tax preparation software typically includes state filing options; however, users must ensure they are aware of their state’s specific requirements and deadlines to avoid complications.

Utilizing Online Tax Prep for Small Business Owners

| Tax Prep Service | Ease of Use | Accuracy Guarantee | Customer Support | Price Range | Best For | State Returns Included |

|---|---|---|---|---|---|---|

| TurboTax | 9/10 | 100% | Phone, Chat, Community | Free – Premium | All tax situations, beginners | Included in paid plans |

| H&R Block | 8/10 | 100% | Phone, Chat, In-person | Free – Premium | In-person support, simple to complex returns | Included in paid plans |

| TaxAct | 7/10 | 100% | Phone, Email | Free – Deluxe | Budget-friendly, experienced filers | Included in paid plans |

| Credit Karma Tax | 8/10 | 100% | Email, Chat | Free | Simple returns, free filing | Included |

| FreeTaxUSA | 7/10 | 100% | Email, Chat | Free – Deluxe | Affordable, federal and state returns | State return fee applies |

For small business owners, online tax preparation can be an invaluable tool in managing their financial responsibilities. Many software options cater specifically to self-employed individuals or small businesses, offering features designed to simplify the complexities of business taxes. For example, platforms like QuickBooks Self-Employed allow users to track income and expenses throughout the year, making it easier to prepare for tax season.

This proactive approach not only streamlines the filing process but also helps business owners maintain accurate financial records. Additionally, online tax preparation software often includes resources tailored to small business needs, such as guidance on deductible business expenses and information on estimated tax payments. Understanding what qualifies as a deductible expense—such as home office costs or vehicle mileage—can significantly impact a business owner’s tax liability.

By utilizing these resources effectively, small business owners can optimize their tax strategies and ensure compliance with IRS regulations.

Tips for a Smooth Online Tax Filing Experience

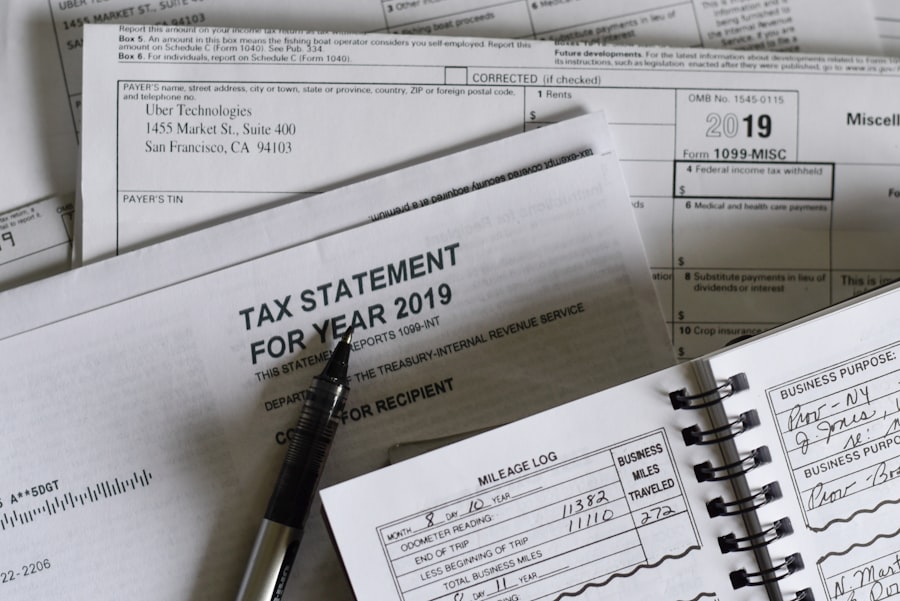

To ensure a seamless online tax filing experience, it is essential to prepare adequately before diving into the process. Start by gathering all necessary documents well in advance, including W-2s, 1099s, receipts for deductible expenses, and any other relevant financial records. Having everything organized will save time and reduce stress when it comes time to input information into the software.

Another helpful tip is to take advantage of any educational resources offered by the online tax preparation platform you choose. Many services provide tutorials or webinars that cover various aspects of tax filing, which can be particularly beneficial for first-time filers or those unfamiliar with recent changes in tax laws. Engaging with these resources can enhance your understanding of the process and empower you to make informed decisions while preparing your return.

Ensuring Security and Privacy with Online Tax Prep

As with any online activity involving sensitive personal information, security and privacy are paramount when using online tax preparation software. It is crucial to choose a platform that prioritizes data protection through encryption and secure servers. Look for software that explicitly states its security measures and complies with industry standards for safeguarding personal information.

Additionally, consider enabling two-factor authentication (2FA) if available. This extra layer of security requires users to verify their identity through a secondary method—such as a text message or email—before accessing their accounts. By taking these precautions, taxpayers can significantly reduce the risk of identity theft or unauthorized access to their financial data.

Seeking Professional Help with Complex Tax Situations

While online tax preparation software is an excellent resource for many individuals and small business owners, there are instances where seeking professional help may be necessary. Complex tax situations—such as those involving multiple income streams, significant investments, or unique deductions—can benefit from the expertise of a certified public accountant (CPA) or tax advisor. These professionals possess in-depth knowledge of tax laws and can provide personalized guidance tailored to your specific circumstances.

Moreover, if you find yourself facing an audit or dealing with unresolved issues from previous years’ returns, enlisting the help of a professional can be invaluable. They can navigate the intricacies of IRS communications and help you develop a strategy for addressing any concerns effectively. In such cases, combining online tools with professional advice can create a comprehensive approach to managing your taxes efficiently and accurately.