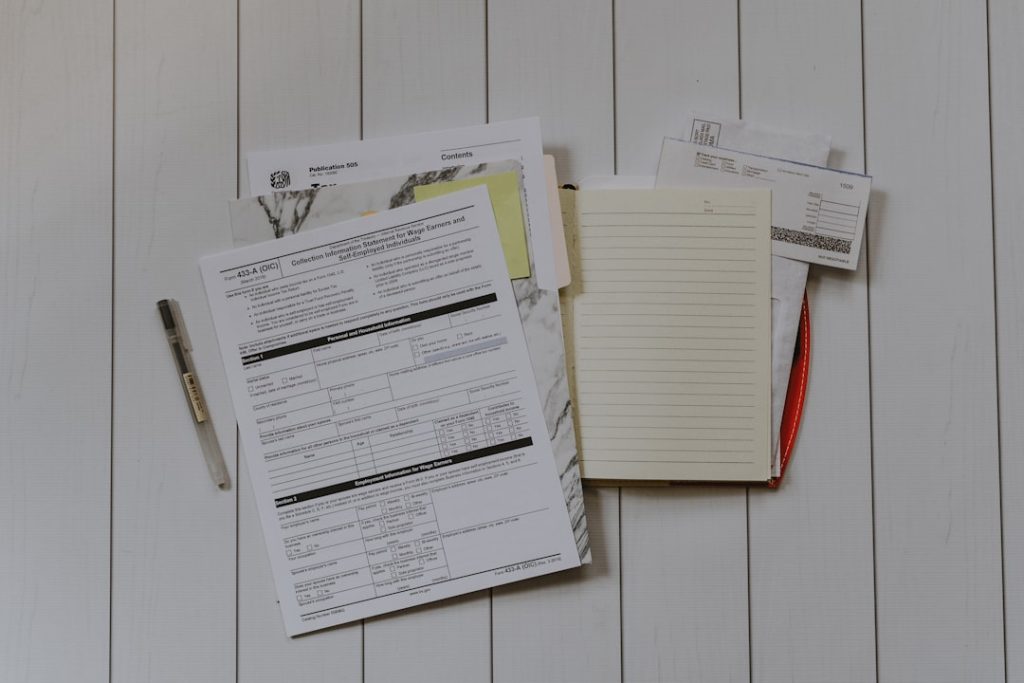

H&R Block operates as a major tax preparation company, providing services to millions of clients annually since its founding in 1955. The company has expanded from a small tax preparation business to a global organization offering comprehensive tax filing solutions. The company provides two primary service delivery methods: in-person consultations and online filing platforms.

H&R Block operates thousands of physical locations throughout the United States where clients can work directly with trained tax professionals. These professionals are equipped to handle complex tax situations and assist clients in meeting compliance requirements while identifying available deductions and credits. H&R Block’s online platform features software designed to accommodate users with varying levels of tax preparation experience.

The system offers multiple service packages tailored to different filing requirements, including basic individual returns, investment income reporting, self-employment tax calculations, and rental property income documentation. The platform includes step-by-step guidance throughout the filing process. Customer support services include live chat assistance and an online knowledge base containing tax-related information and guidance.

These resources are designed to help users understand tax requirements and available filing options throughout the preparation process.

Key Takeaways

- H&R Block offers comprehensive tax filing services, including online and in-person options.

- Utilizing H&R Block’s deduction and credit finder can help maximize your tax refund.

- Their online filing system is user-friendly, with tips to navigate it efficiently.

- Working with H&R Block tax professionals provides expert guidance and reduces filing errors.

- Additional services and financial tools from H&R Block help you make the most of your tax refund.

Tips for Maximizing Your Refund with H&R Block

Maximizing your tax refund is a priority for many taxpayers, and H&R Block provides several strategies to help achieve this goal. One effective approach is to ensure that all eligible deductions and credits are claimed. Taxpayers often overlook deductions related to education expenses, medical costs, and charitable contributions.

H&R Block’s software includes prompts and suggestions that can help identify these potential deductions, ensuring that nothing is missed during the filing process. Additionally, taxpayers should consider their filing status carefully; for instance, married couples may benefit from filing jointly rather than separately, as this can lead to a higher refund due to various tax breaks available to joint filers. Another important tip is to keep meticulous records throughout the year.

H&R Block emphasizes the importance of maintaining organized documentation of income, expenses, and receipts. This not only simplifies the filing process but also ensures that all relevant information is readily available when it comes time to file taxes. Utilizing H&R Block’s mobile app can be particularly beneficial for tracking expenses on-the-go.

The app allows users to take photos of receipts and categorize expenses in real-time, which can be invaluable when it comes time to claim deductions.

How to Navigate H&R Block’s Online Filing System

Navigating H&R Block’s online filing system can be a straightforward process if users familiarize themselves with its features and layout. Upon logging into the platform, users are greeted with a dashboard that provides an overview of their tax situation and prompts them to begin the filing process. The system is designed with a step-by-step approach, guiding users through each section of the tax return.

This structured format helps alleviate any confusion that may arise from the complexity of tax forms and regulations. One of the standout features of H&R Block’s online system is its ability to import previous year’s tax returns from other providers or from H&R Block itself. This feature not only saves time but also ensures continuity in reporting income and deductions.

Users can also take advantage of the built-in calculators for estimating their refund or tax liability as they progress through the filing process. Additionally, the platform offers a comprehensive FAQ section and access to live chat support, allowing users to seek assistance whenever they encounter challenges or have questions about specific entries.

Utilizing H&R Block’s Deduction and Credit Finder

H&R Block’s Deduction and Credit Finder is an invaluable tool for taxpayers looking to maximize their refunds by identifying all possible deductions and credits available to them. This feature employs a questionnaire format that prompts users to answer questions about their financial situation, lifestyle, and expenses throughout the year. Based on the responses provided, the tool generates a tailored list of deductions and credits that may apply, ensuring that users do not overlook any potential savings.

For example, if a taxpayer indicates that they have incurred education-related expenses, the Deduction and Credit Finder will highlight opportunities such as the American Opportunity Credit or Lifetime Learning Credit. Similarly, homeowners can benefit from deductions related to mortgage interest or property taxes. By utilizing this tool effectively, taxpayers can significantly enhance their understanding of what they qualify for, leading to a more accurate return and potentially larger refund.

The Benefits of Working with H&R Block Tax Professionals

| Metric | Details |

|---|---|

| Service Name | H&R Block Tax Filing |

| Filing Options | Online, In-Person, Software Download |

| Federal Filing Cost | Free to Premium Plans (varies by complexity) |

| State Filing Cost | Additional fee applies per state return |

| Maximum Refund Guarantee | Yes |

| Audit Support | Free Audit Support Included |

| Customer Support | Phone, Chat, In-Person Assistance |

| Accuracy Guarantee | Yes, with reimbursement for penalties and interest |

| Typical Filing Time | 30 minutes to 1 hour (varies by complexity) |

| Mobile App Availability | Yes, iOS and Android |

While many individuals opt for DIY tax filing through online platforms, there are distinct advantages to working with H&R Block’s tax professionals. One of the primary benefits is access to expert knowledge and personalized advice tailored to individual circumstances. Tax professionals at H&R Block undergo rigorous training and are well-versed in current tax laws and regulations.

This expertise can be particularly beneficial for those with complex financial situations, such as business owners or individuals with multiple income streams. Moreover, working with a tax professional can provide peace of mind during the filing process. Clients can ask questions directly and receive immediate feedback on their concerns or uncertainties regarding deductions, credits, or potential audits.

Additionally, H&R Block offers a guarantee that if any errors are made by their tax professionals resulting in penalties or interest charges, they will cover those costs. This assurance adds an extra layer of security for clients who may be apprehensive about navigating the intricacies of tax law on their own.

Avoiding Common Mistakes When Filing with H&R Block

Filing taxes can be fraught with pitfalls, and even seasoned taxpayers can make mistakes that may lead to delays or reduced refunds. One common error is failing to double-check personal information such as Social Security numbers or bank account details before submitting the return. H&R Block’s online system includes built-in checks that alert users to potential discrepancies; however, it is still advisable for taxpayers to review their information carefully before finalizing their submission.

Another frequent mistake involves neglecting to report all sources of income. Taxpayers sometimes forget about freelance work or side jobs that may not have been reported on a W-2 form. H&R Block encourages users to gather all relevant documents before starting their return, including 1099 forms for freelance income or investment earnings.

By ensuring that all income is accurately reported, taxpayers can avoid issues with the IRS down the line.

Exploring Additional Tax Services Offered by H&R Block

In addition to standard tax preparation services, H&R Block offers a variety of additional services designed to meet diverse client needs. One notable service is their tax planning consultation, which allows clients to strategize for future tax years based on current financial situations and goals. This proactive approach can help individuals make informed decisions regarding investments, retirement accounts, and other financial matters that may impact their tax liabilities.

H&R Block also provides audit support services for clients who may face an audit from the IRS or state tax authorities. Their professionals are equipped to assist clients in navigating the audit process, ensuring that all necessary documentation is prepared and submitted correctly. Furthermore, H&R Block offers identity theft protection services that monitor clients’ personal information for signs of fraud or misuse—a growing concern in today’s digital age.

Making the Most of Your Refund with H&R Block’s Financial Tools

Once taxpayers receive their refunds from H&R Block, it’s essential to consider how best to utilize these funds for long-term financial health. H&R Block offers various financial tools designed to help clients make informed decisions about their refunds. For instance, clients can access budgeting tools that allow them to allocate their refund towards savings goals, debt repayment, or investments.

Additionally, H&R Block provides resources for individuals interested in exploring investment opportunities with their refunds. Whether it’s opening a retirement account or investing in stocks or mutual funds, having access to financial guidance can empower clients to make choices that align with their financial objectives. By leveraging these tools effectively, taxpayers can transform their refunds into stepping stones toward greater financial stability and growth.