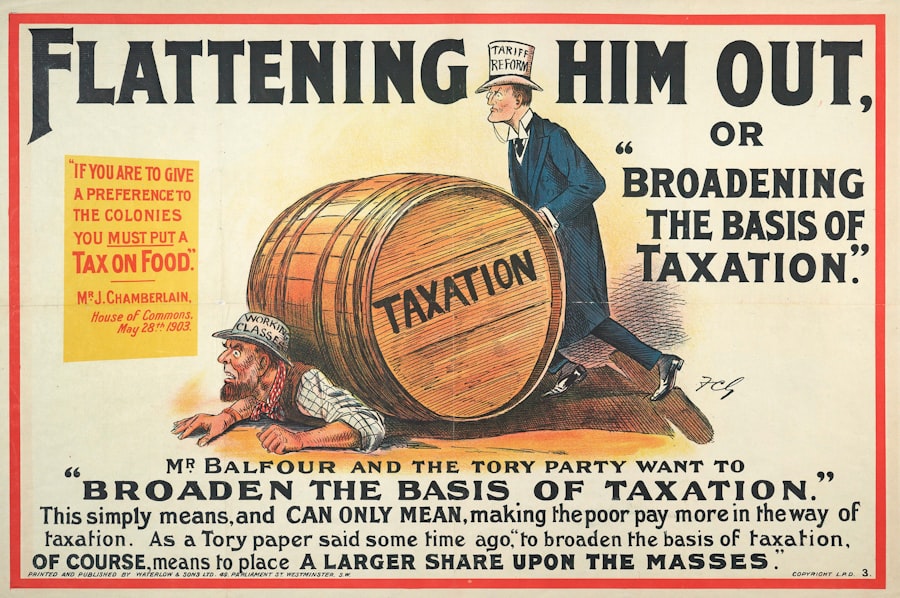

Certified Public Accountants (CPAs) play a pivotal role in the realm of taxation, serving as trusted advisors who navigate the complexities of tax laws and regulations. A CPA is not merely a tax preparer; they are licensed professionals who have passed rigorous examinations and met specific educational and experience requirements. This certification allows them to provide a wide array of services, including tax preparation, tax planning, and financial consulting.

Understanding CPA taxes involves recognizing the breadth of knowledge these professionals possess, which extends beyond mere number crunching to encompass a deep understanding of tax codes, compliance issues, and financial strategies. The tax landscape is continually evolving, influenced by changes in legislation, economic conditions, and individual circumstances. CPAs stay abreast of these changes, ensuring that their clients are compliant with current laws while also maximizing potential deductions and credits.

For instance, the Tax Cuts and Jobs Act of 2017 introduced significant changes to individual and corporate tax rates, as well as alterations to itemized deductions. A knowledgeable CPA can help clients navigate these changes effectively, ensuring that they take full advantage of available benefits while avoiding pitfalls that could lead to audits or penalties.

Key Takeaways

- CPAs provide specialized knowledge essential for accurate tax preparation and compliance.

- Expert financial guidance from a CPA can optimize tax savings and planning strategies.

- Locating a qualified CPA nearby involves researching credentials, experience, and client reviews.

- Key qualities in a CPA include expertise, communication skills, and understanding of your financial situation.

- Hiring a CPA offers benefits like improved tax compliance, strategic planning, and peace of mind.

The Importance of Expert Financial Guidance

In an increasingly complex financial environment, the importance of expert financial guidance cannot be overstated. Many individuals and businesses find themselves overwhelmed by the intricacies of tax regulations and financial planning. A CPA provides clarity and direction, helping clients make informed decisions that align with their financial goals.

This guidance is particularly crucial during tax season when the pressure to file accurately and on time can lead to mistakes that may have long-term repercussions. Moreover, expert financial guidance extends beyond just tax preparation. CPAs can assist with budgeting, investment strategies, retirement planning, and estate planning.

Their comprehensive understanding of financial principles allows them to offer tailored advice that considers both short-term needs and long-term objectives. For example, a CPA might recommend specific retirement accounts or investment vehicles that align with a client’s risk tolerance and future aspirations. This holistic approach ensures that clients are not only compliant with tax laws but are also strategically positioned for financial success.

How to Find a CPA Near Me

Finding a CPA near you can be a straightforward process if approached methodically. One effective way to start is by seeking recommendations from friends, family, or colleagues who have had positive experiences with local CPAs. Personal referrals often provide insights into the CPA’s expertise, communication style, and overall effectiveness.

Additionally, online platforms such as Yelp or Google Reviews can offer valuable feedback from a broader audience, helping you gauge the reputation of potential candidates. Another avenue for finding a CPA is through professional organizations such as the American Institute of CPAs (AICPA) or state-specific CPA societies. These organizations often have directories that allow you to search for licensed CPAs based on your location and specific needs.

Furthermore, many CPAs now maintain an online presence through websites or social media platforms, where they share information about their services, areas of expertise, and client testimonials. This digital footprint can provide a wealth of information to help you make an informed decision.

What to Look for in a CPA

When selecting a CPA, several key factors should be considered to ensure that you find the right fit for your financial needs. First and foremost, it is essential to verify the CPA’s credentials and experience. Look for someone who holds a valid CPA license in your state and has relevant experience in your specific area of concern—be it individual taxes, business taxes, or specialized industries such as real estate or healthcare.

A CPA with a strong background in your particular financial situation will be better equipped to provide tailored advice. Communication style is another critical aspect to consider. A good CPA should be approachable and willing to explain complex tax concepts in a way that is easy to understand.

During your initial consultation, pay attention to how well the CPA listens to your concerns and whether they take the time to address your questions thoroughly. Additionally, consider their availability throughout the year; some CPAs may only focus on tax season while others offer year-round support for ongoing financial planning and advice.

Benefits of Hiring a CPA for Tax Preparation

| CPA Firm | Location | Average CPA Tax Preparation Cost | Services Offered | Customer Rating (out of 5) | Contact |

|---|---|---|---|---|---|

| Smith & Associates CPA | New York, NY | 300 | Tax Preparation, Tax Planning, Audit Support | 4.7 | (212) 555-1234 |

| Green Tax Advisors | Los Angeles, CA | 250 | Individual & Business Tax Returns, Consulting | 4.5 | (310) 555-5678 |

| Johnson CPA Services | Chicago, IL | 275 | Tax Preparation, Bookkeeping, Financial Planning | 4.6 | (773) 555-9012 |

| Elite Tax Solutions | Houston, TX | 320 | Tax Preparation, IRS Representation, Payroll Services | 4.8 | (713) 555-3456 |

| Precision CPA Group | Phoenix, AZ | 290 | Tax Preparation, Business Consulting, Estate Planning | 4.4 | (602) 555-7890 |

Hiring a CPA for tax preparation offers numerous advantages that can significantly impact your financial well-being. One of the most notable benefits is the assurance of accuracy in your tax filings. CPAs are trained professionals who understand the intricacies of tax codes and regulations, which minimizes the risk of errors that could lead to audits or penalties.

Their expertise allows them to identify potential deductions and credits that you may not be aware of, ultimately reducing your tax liability. Additionally, CPAs can save you valuable time during the often-stressful tax season. Preparing taxes can be a daunting task that requires meticulous attention to detail and an understanding of various forms and schedules.

By entrusting this responsibility to a CPA, you free up time to focus on other important aspects of your life or business. Furthermore, many CPAs utilize advanced software tools that streamline the preparation process, ensuring efficiency and accuracy in filing.

How a CPA Can Help with Tax Planning

Tax planning is an essential component of effective financial management, and CPAs are uniquely positioned to assist clients in this area. Unlike tax preparation, which typically occurs once a year during tax season, tax planning is an ongoing process that involves strategizing throughout the year to minimize tax liabilities. A CPA can help you develop a comprehensive tax strategy that aligns with your financial goals while taking into account current laws and regulations.

For example, a CPA might recommend contributing to retirement accounts such as IRAs or 401(k)s as a means of reducing taxable income while simultaneously preparing for future financial needs. They can also advise on timing income and expenses strategically—such as deferring income to a future year when you expect to be in a lower tax bracket or accelerating deductible expenses into the current year—to optimize your overall tax situation. This proactive approach not only helps in minimizing taxes but also enhances your overall financial health.

The Role of a CPA in Tax Compliance

Tax compliance is a critical aspect of maintaining good standing with the IRS and state tax authorities. A CPA plays an integral role in ensuring that individuals and businesses adhere to all applicable tax laws and regulations. This involves not only accurate filing but also understanding the nuances of compliance requirements that vary by jurisdiction and type of entity.

For instance, businesses may face different compliance obligations than individual taxpayers, including payroll taxes, sales taxes, and corporate income taxes. CPAs help clients navigate these complexities by providing guidance on record-keeping practices, deadlines for filing returns, and necessary documentation for deductions or credits claimed. They can also represent clients in case of audits or disputes with tax authorities, leveraging their expertise to advocate on behalf of their clients effectively.

This level of support is invaluable for individuals and businesses alike, as it mitigates risks associated with non-compliance and fosters peace of mind.

Finding the Right CPA for Your Financial Needs

Ultimately, finding the right CPA for your financial needs requires careful consideration of various factors beyond just qualifications and experience. It is essential to assess how well a potential CPA aligns with your personal values and financial philosophy. For instance, if you prioritize proactive communication and regular check-ins regarding your financial status, seek out a CPA who emphasizes these practices in their client relationships.

Additionally, consider the range of services offered by the CPA firm. Some CPAs specialize solely in tax preparation while others provide comprehensive financial services that include investment advice, estate planning, and business consulting. Depending on your current needs and future aspirations, selecting a CPA who can grow with you over time may prove beneficial.

Engaging in an open dialogue during initial consultations can help clarify expectations and ensure that both parties are aligned in their approach to achieving your financial goals. In conclusion, navigating the world of taxes can be daunting without expert guidance. A qualified CPA not only simplifies this process but also empowers clients with knowledge and strategies that enhance their overall financial health.

By understanding what CPAs do, recognizing their value in tax planning and compliance, and knowing how to find the right professional for your needs, you can take significant steps toward achieving financial success.