Audit planning is a critical phase in the audit process that lays the groundwork for a successful audit engagement. It serves as a roadmap, guiding auditors through the complexities of the audit while ensuring that all necessary areas are addressed. A well-structured audit plan not only enhances the efficiency of the audit but also improves the quality of the findings and recommendations.

By establishing a clear framework, auditors can allocate their time and resources effectively, minimizing the risk of overlooking significant issues that could impact the integrity of financial statements or operational processes. Moreover, effective audit planning fosters a proactive approach to identifying potential problems before they escalate. By anticipating challenges and understanding the environment in which an organization operates, auditors can tailor their procedures to address specific risks.

This foresight is particularly important in today’s dynamic business landscape, where regulatory requirements and market conditions are constantly evolving. A robust audit plan not only helps in compliance with legal standards but also adds value to the organization by providing insights that can lead to improved operational efficiency and risk management.

Key Takeaways

- Effective audit planning is crucial for ensuring a thorough and efficient audit process.

- Defining clear objectives and scope sets the foundation for focused audit activities.

- Identifying risks and controls helps prioritize audit efforts and mitigate potential issues.

- Leveraging technology enhances audit efficiency and accuracy.

- Continuous monitoring and collaboration with stakeholders enable timely adjustments to the audit plan.

Key Components of Audit Planning

The audit planning process encompasses several key components that collectively contribute to its effectiveness. One of the primary elements is the understanding of the entity being audited, which includes its industry, regulatory environment, and internal controls. This understanding allows auditors to assess the inherent risks associated with the organization’s operations and financial reporting.

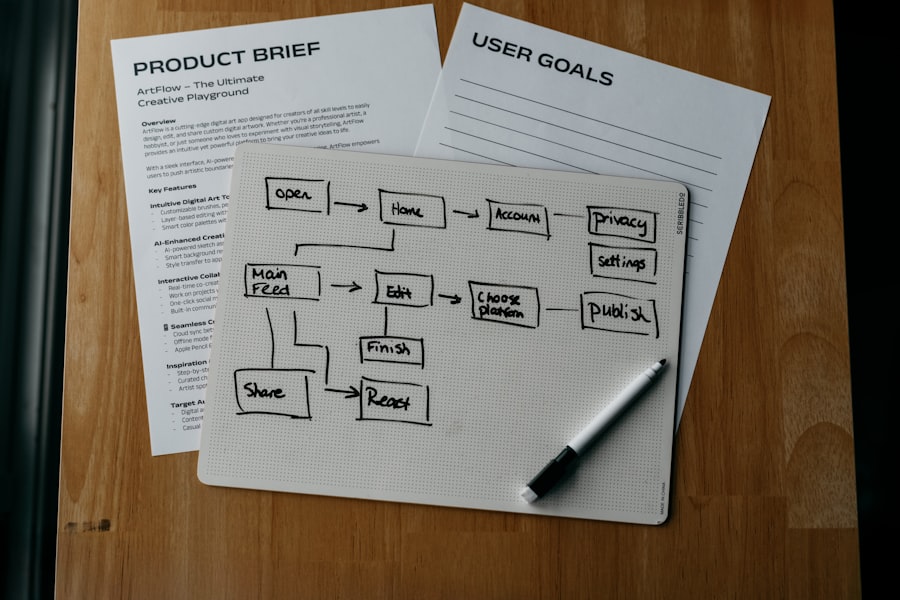

Additionally, auditors must consider the previous audit findings and any changes in the organization since the last audit, as these factors can significantly influence the current audit approach. Another essential component is the development of an audit strategy that outlines the overall approach to the audit. This strategy should detail the nature, timing, and extent of audit procedures to be performed.

It is crucial for auditors to determine whether to adopt a substantive approach, focusing on detailed testing of transactions and balances, or a controls-based approach, which emphasizes testing the effectiveness of internal controls. The choice of strategy will depend on various factors, including the assessed risks and the reliability of the internal control system.

Establishing Clear Objectives and Scope

Establishing clear objectives is fundamental to effective audit planning. Objectives should be specific, measurable, achievable, relevant, and time-bound (SMART). For instance, an objective might be to assess whether the financial statements present a true and fair view of the organization’s financial position in accordance with applicable accounting standards.

By defining such objectives, auditors can focus their efforts on areas that are most critical to stakeholders and ensure that their work aligns with the expectations of management and regulatory bodies. The scope of the audit must also be clearly defined to avoid ambiguity and ensure that all relevant areas are covered. This includes determining which financial statements will be audited, the time period under review, and any specific areas of concern that need special attention.

For example, if an organization has recently undergone significant changes such as mergers or acquisitions, these areas may require additional scrutiny. By clearly delineating the scope, auditors can manage their resources effectively and ensure that they address all pertinent issues within the allocated timeframe.

Identifying Risks and Controls

A crucial aspect of audit planning involves identifying risks that could affect the accuracy and reliability of financial reporting. This process begins with a thorough risk assessment, which includes both inherent risks—those arising from the nature of the business—and control risks—those related to deficiencies in internal controls. For instance, an organization operating in a volatile market may face heightened inherent risks due to fluctuating demand or regulatory changes.

Understanding these risks allows auditors to tailor their procedures accordingly. In conjunction with risk identification, auditors must evaluate the effectiveness of existing internal controls designed to mitigate those risks. This evaluation involves assessing whether controls are properly designed and implemented and whether they are functioning as intended.

For example, if an organization has a robust system for monitoring inventory levels but lacks adequate segregation of duties in its purchasing process, auditors may need to focus on testing controls related to procurement to ensure that there are no opportunities for fraud or error. By identifying both risks and controls early in the planning phase, auditors can develop a more targeted and efficient audit approach.

Utilizing Technology for Efficiency

| Audit Planning Metric | Description | Typical Value/Range | Importance |

|---|---|---|---|

| Audit Scope Definition | Determines the boundaries and extent of the audit | Specific departments, processes, or financial statements | High |

| Risk Assessment Level | Evaluation of potential risks that could affect audit outcomes | Low, Medium, High | High |

| Materiality Threshold | Amount or level at which misstatements become significant | Varies by entity size; e.g., 0.5% to 5% of net income | High |

| Audit Team Size | Number of auditors assigned to the audit | 2-10 members | Medium |

| Estimated Audit Hours | Projected total hours required to complete the audit | 50-500 hours depending on scope | High |

| Key Control Identification | Number of critical controls identified for testing | 5-20 controls | High |

| Preliminary Analytical Procedures | Initial analysis to identify unusual trends or variances | Performed on all major accounts | Medium |

| Client Communication Frequency | Number of planned meetings or updates with client | Weekly or bi-weekly | Medium |

| Documentation Completion Rate | Percentage of planning documents completed before fieldwork | 100% | High |

In recent years, technology has transformed the audit landscape, offering tools that enhance efficiency and effectiveness in audit planning and execution. Data analytics is one such tool that allows auditors to analyze large volumes of data quickly and accurately. By leveraging data analytics, auditors can identify trends, anomalies, and potential areas of concern that may warrant further investigation.

For instance, analyzing transaction patterns can help auditors detect unusual activities that could indicate fraud or misstatements. Additionally, audit management software has become increasingly prevalent in streamlining various aspects of the audit process. These platforms facilitate collaboration among team members, automate routine tasks, and provide real-time access to documentation and findings.

By utilizing such technology, auditors can reduce manual errors, improve communication within teams, and ultimately enhance the quality of their work. The integration of technology into audit planning not only increases efficiency but also allows auditors to focus on higher-value activities that require professional judgment and expertise.

Engaging Stakeholders and Team Collaboration

Engaging stakeholders throughout the audit planning process is essential for ensuring that the audit meets their needs and expectations. Stakeholders may include management, board members, and other relevant parties who have a vested interest in the outcomes of the audit. By involving these individuals early on, auditors can gain valuable insights into specific concerns or areas that require attention.

This collaborative approach fosters transparency and builds trust between auditors and stakeholders. Team collaboration is equally important in developing a comprehensive audit plan. Auditors often work in teams with diverse skill sets and expertise; therefore, leveraging this collective knowledge can lead to more effective planning.

Regular team meetings allow members to share insights about potential risks or challenges they have encountered in previous audits or within their areas of expertise. Furthermore, assigning roles based on individual strengths ensures that each team member contributes effectively to the overall audit strategy.

Allocating Resources and Budgeting

Effective resource allocation is a cornerstone of successful audit planning. Auditors must assess their available resources—including personnel, time, and budget—to ensure that they can execute the audit plan efficiently. This involves determining how many team members will be needed for various phases of the audit and whether additional expertise is required for specialized areas such as IT or tax compliance.

For example, if an organization has complex IT systems that require evaluation, auditors may need to allocate resources specifically for IT specialists who can assess system controls. Budgeting is another critical aspect of resource allocation in audit planning. Auditors must estimate costs associated with personnel time, travel expenses, technology tools, and any external consultants required for specialized tasks.

A well-prepared budget not only helps in managing costs but also ensures that auditors have sufficient resources to conduct a thorough examination without compromising quality due to financial constraints. By carefully considering both resource allocation and budgeting during the planning phase, auditors can set themselves up for success in executing their audit plan.

Monitoring and Adjusting the Audit Plan

The dynamic nature of business environments necessitates ongoing monitoring and adjustment of the audit plan throughout its execution. As auditors progress through their work, they may encounter new information or changes in circumstances that warrant a reevaluation of their initial plan. For instance, if significant discrepancies are identified during preliminary testing, auditors may need to expand their scope or alter their procedures to address these findings adequately.

Regular communication among team members is vital for effective monitoring of the audit plan. Team meetings should be held periodically to discuss progress, share insights, and address any challenges encountered during fieldwork. This collaborative approach allows for real-time adjustments to be made based on emerging risks or issues identified during the audit process.

By remaining flexible and responsive to changes, auditors can ensure that their work remains relevant and aligned with organizational objectives while delivering valuable insights to stakeholders throughout the engagement.