Maximize Your Refund with H&R Block Tax Preparer

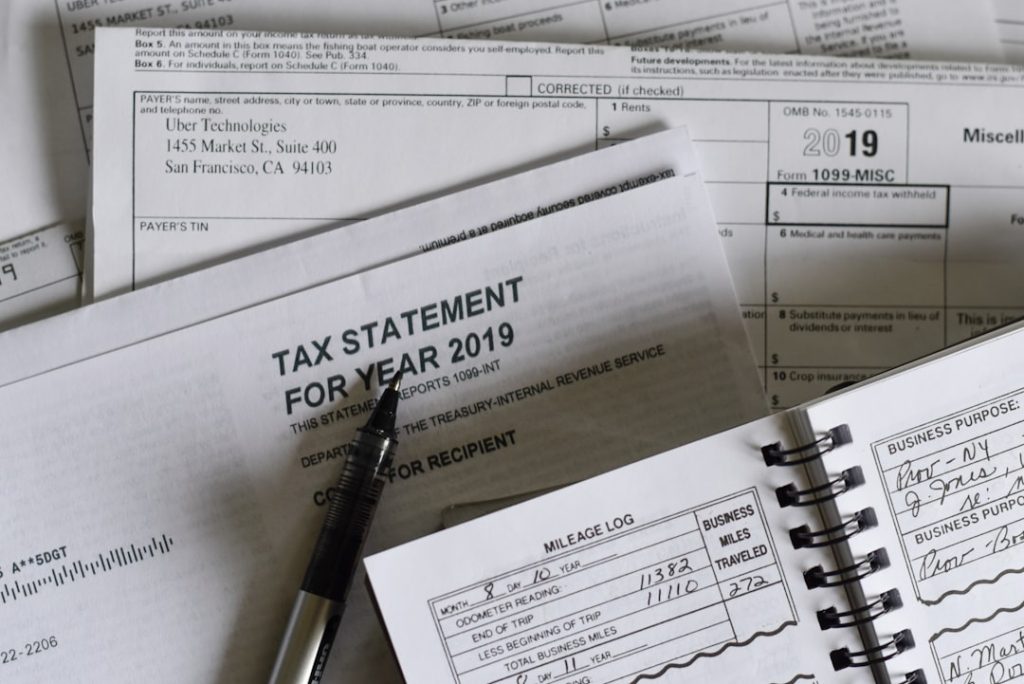

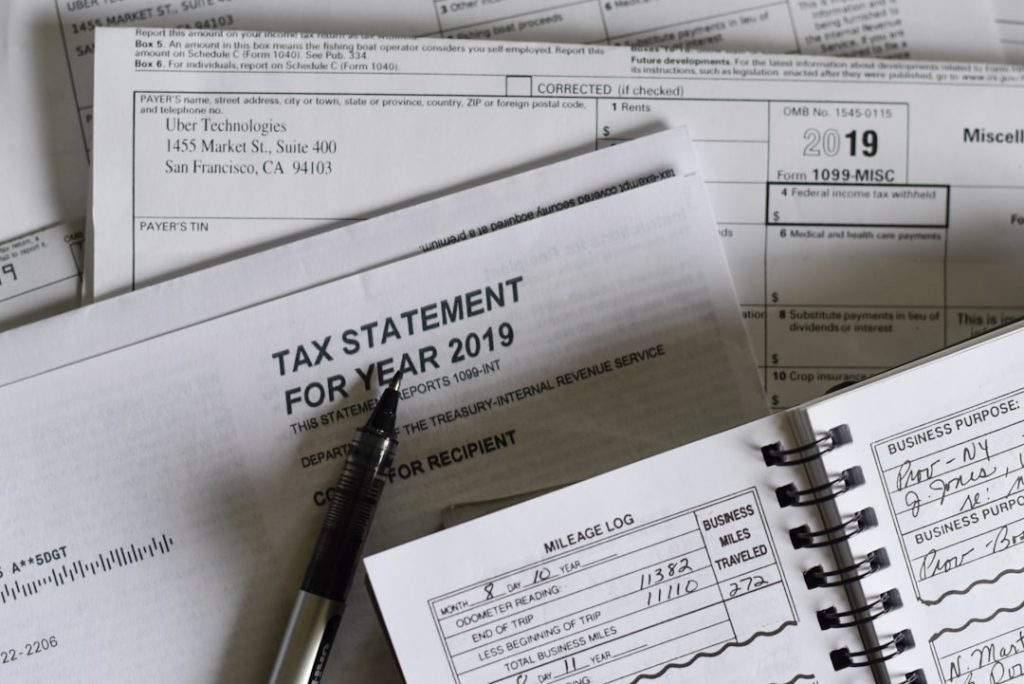

H&R Block operates as a major tax preparation company serving both individual and business clients. The company’s tax preparers provide professional expertise in navigating complex tax regulations that undergo frequent modifications. These preparers receive training on current tax laws and can identify applicable deductions and credits that may increase refund amounts or reduce tax liabilities. […]

Maximize Your Refund with H&R Block Tax Preparer Read More »