Restaurant accounting software serves as a specialized financial management tool designed to address the operational complexities of food service establishments. These systems handle industry-specific requirements including food cost tracking, labor expense management, and revenue fluctuation analysis. The software automates routine accounting processes, reducing manual data entry errors and processing time.

Modern restaurant accounting platforms integrate with existing business systems, including point-of-sale (POS) terminals and inventory management software. This integration creates unified data streams that enable real-time financial monitoring and reporting. Restaurant operators can access current information on costs, sales performance, and profit margins through centralized dashboards.

Traditional manual accounting methods using spreadsheets present limitations in accuracy and efficiency for restaurant operations. Contemporary software solutions provide automated data synchronization, standardized reporting formats, and analytical tools that support operational decision-making. These systems typically include features for tracking food costs as percentages of revenue, monitoring labor costs against sales targets, and generating financial reports required for business management and tax compliance.

Key Takeaways

- Restaurant accounting software simplifies financial management and improves accuracy.

- Key benefits include time savings, error reduction, and better financial insights.

- Important features to consider are POS integration, inventory tracking, and budgeting tools.

- Choosing the right software involves assessing your restaurant’s size, needs, and compatibility.

- Integration with POS systems and compliance tools enhances reporting and operational efficiency.

Benefits of Using Accounting Software for Restaurants

One of the primary benefits of utilizing accounting software in a restaurant setting is the enhancement of operational efficiency. By automating routine tasks such as invoicing, payroll processing, and expense tracking, restaurant owners can significantly reduce the time spent on administrative duties. This efficiency not only frees up valuable time for managers and staff but also minimizes the risk of errors that can arise from manual data entry.

For instance, automated payroll systems can ensure that employees are paid accurately and on time, fostering a positive work environment and reducing turnover. Another significant advantage is the ability to gain real-time insights into financial performance. Restaurant accounting software provides detailed reports and analytics that allow owners to monitor key performance indicators (KPIs) such as food cost percentages, labor costs, and overall profitability.

With this information at their fingertips, restaurateurs can quickly identify trends and make necessary adjustments to their operations. For example, if a particular menu item is consistently underperforming, owners can analyze the data to determine whether it’s a pricing issue or a problem with food quality or presentation.

Features to Look for in Restaurant Accounting Software

When selecting accounting software for a restaurant, it is essential to consider specific features that cater to the unique needs of the industry. One critical feature is inventory management integration. Effective inventory management is vital for controlling food costs and minimizing waste.

Software that allows for real-time tracking of inventory levels can help restaurant owners maintain optimal stock levels and avoid over-ordering or running out of popular items. Additionally, features that enable recipe costing can provide insights into the profitability of individual dishes. Another important feature is multi-location support for restaurants with multiple branches.

This capability allows owners to consolidate financial data across various locations, providing a comprehensive view of overall performance. Multi-location support can also facilitate centralized reporting and budgeting, making it easier to identify which locations are thriving and which may require additional attention or resources. Furthermore, user-friendly interfaces and mobile accessibility are essential for ensuring that staff can easily navigate the software and access critical information on-the-go.

How to Choose the Right Accounting Software for Your Restaurant

Choosing the right accounting software for a restaurant involves careful consideration of several factors. First and foremost, it is crucial to assess the specific needs of the establishment. For instance, a small café may require different functionalities compared to a large fine-dining restaurant.

Owners should evaluate their current pain points in financial management and identify which features would address those challenges effectively. Engaging with staff who will be using the software can also provide valuable insights into what functionalities are necessary for daily operations. Cost is another significant factor in the decision-making process.

While investing in quality accounting software is essential, it is equally important to ensure that it fits within the restaurant’s budget. Many software providers offer tiered pricing models based on features and user access levels, allowing owners to select a plan that aligns with their financial capabilities. Additionally, considering customer support options is vital; robust customer service can make a significant difference when troubleshooting issues or seeking guidance on utilizing specific features effectively.

Integrating Accounting Software with Point of Sale Systems

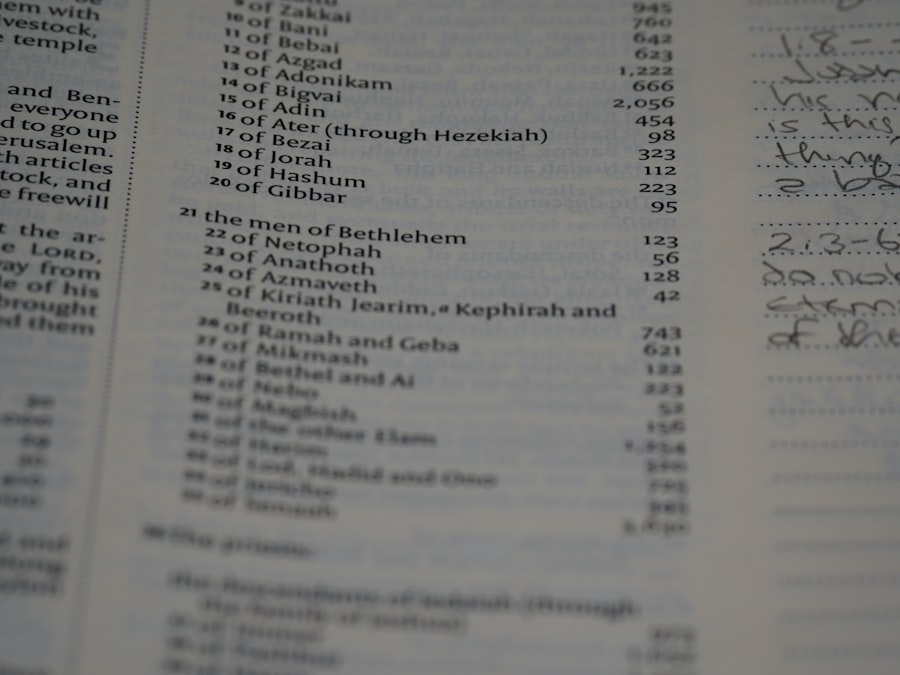

| Feature | Description | Benefit | Common Metrics |

|---|---|---|---|

| Sales Tracking | Monitors daily, weekly, and monthly sales transactions | Helps identify peak hours and popular menu items | Daily sales volume, average ticket size, sales growth % |

| Expense Management | Tracks all operational expenses including inventory and payroll | Improves cost control and budgeting accuracy | Cost of goods sold (COGS), labor cost %, overhead expenses |

| Inventory Management | Monitors stock levels and usage rates of ingredients | Reduces waste and prevents stockouts | Inventory turnover ratio, waste percentage, reorder frequency |

| Payroll Integration | Automates employee wage calculations and tax deductions | Ensures timely and accurate payroll processing | Labor cost %, hours worked, overtime hours |

| Financial Reporting | Generates profit and loss statements, balance sheets, and cash flow reports | Supports informed decision-making and financial planning | Net profit margin, gross profit margin, cash flow status |

| Tax Compliance | Calculates and prepares tax filings specific to the restaurant industry | Reduces risk of penalties and audits | Sales tax collected, tax filing deadlines met, tax liabilities |

The integration of accounting software with point of sale (POS) systems is a game-changer for restaurants looking to streamline their financial processes. POS systems capture sales data in real-time, providing invaluable insights into daily revenue and customer preferences. When this data is automatically synced with accounting software, it eliminates the need for manual entry and reduces the risk of discrepancies between sales figures and financial records.

For example, when a customer places an order at the POS system, the transaction details—such as itemized sales, taxes collected, and payment methods—are instantly recorded in the accounting software. This seamless integration allows restaurant owners to generate accurate financial reports without delay. Moreover, it enables them to track sales trends over time, helping them make informed decisions about menu adjustments or promotional strategies based on customer behavior.

Streamlining Inventory Management with Accounting Software

Effective inventory management is critical for maintaining profitability in the restaurant industry. Accounting software designed specifically for restaurants often includes robust inventory management features that allow owners to track stock levels in real-time. This capability helps prevent overstocking or stockouts, both of which can negatively impact a restaurant’s bottom line.

For instance, when ingredients are used in menu items, the software can automatically update inventory levels accordingly. This real-time tracking ensures that managers are always aware of what items need to be reordered and when they should be ordered to avoid disruptions in service. Additionally, some advanced systems offer features like par-level tracking, which helps establish optimal inventory levels based on historical usage patterns.

By utilizing these tools, restaurant owners can minimize waste and maximize efficiency in their operations.

Using Accounting Software for Budgeting and Forecasting

Budgeting and forecasting are essential components of effective financial management in any business, including restaurants. Accounting software provides powerful tools that enable owners to create detailed budgets based on historical data and projected sales trends. By analyzing past performance metrics, restaurateurs can develop realistic budgets that account for seasonal fluctuations in revenue and expenses.

Moreover, many accounting software solutions offer forecasting capabilities that allow owners to simulate various scenarios based on different variables such as changes in menu pricing or labor costs. For example, if a restaurant owner considers raising prices on certain menu items, they can use forecasting tools to predict how this change might impact overall revenue and customer traffic. This level of analysis empowers restaurateurs to make strategic decisions that align with their financial goals while minimizing risks associated with uncertainty.

Ensuring Compliance and Reporting with Restaurant Accounting Software

Compliance with tax regulations and reporting requirements is a critical aspect of running a successful restaurant. Accounting software designed for the food service industry often includes features that simplify tax calculations and ensure compliance with local regulations. For instance, many systems automatically calculate sales tax based on current rates and generate reports that facilitate tax filing processes.

Additionally, robust reporting capabilities allow restaurant owners to generate various financial statements—such as profit and loss statements, balance sheets, and cash flow statements—quickly and accurately. These reports are essential not only for internal decision-making but also for external stakeholders such as investors or lenders who may require detailed financial information before making funding decisions. By leveraging accounting software’s compliance features, restaurant owners can focus on growing their business while ensuring they meet all regulatory obligations efficiently.