Section 87A of the Income Tax Act, 1961, provides a tax rebate for individual taxpayers in India with lower incomes. This provision allows eligible taxpayers to reduce their tax liability, increasing their disposable income. The government implemented this section to reduce financial pressure on individuals earning below specific thresholds, which helps promote economic stability and consumer spending.

The rebate applies to individuals whose total taxable income falls below a designated limit, which has been periodically adjusted to account for inflation and economic changes. The rebate is calculated as a percentage of the total tax payable, subject to a maximum amount. For taxpayers within the qualifying income bracket, this provision significantly reduces their tax burden, making it an important consideration in personal financial planning.

Key Takeaways

- Section 87A provides a tax rebate to reduce tax liability for eligible individual taxpayers.

- Eligibility for the rebate depends on income thresholds and specific criteria set by the government.

- The rebate amount is calculated based on taxable income and is subject to a maximum limit.

- Taxpayers can maximize savings by accurately claiming the rebate and ensuring they meet all eligibility requirements.

- Avoid common errors like incorrect income reporting or missing deadlines to successfully claim the rebate.

Eligibility Criteria for Section 87A Tax Rebate

To qualify for the Section 87A tax rebate, individuals must meet specific eligibility criteria set forth by the Income Tax Department. Primarily, the taxpayer’s total taxable income must not exceed ₹5 lakh in a financial year. This threshold is crucial as it determines who can benefit from the rebate.

It is important to note that this limit applies to the net taxable income after accounting for deductions under various sections, such as Section 80C, 80D, and others. Additionally, the rebate is available only to resident individuals, which means that non-resident Indians (NRIs) and foreign citizens are not eligible. Furthermore, taxpayers must ensure that they do not have any income from sources that are exempt from tax, as this could affect their overall taxable income calculation.

Understanding these criteria is vital for individuals seeking to take advantage of the rebate, as failing to meet any of these conditions could result in disqualification.

How to Calculate Section 87A Tax Rebate

Calculating the Section 87A tax rebate involves a straightforward process that begins with determining the total taxable income of the individual. Once this figure is established, taxpayers can assess whether they fall within the eligible income bracket. If the total taxable income is ₹5 lakh or less, the next step is to calculate the total tax liability before applying any rebates.

For instance, if an individual’s total tax liability amounts to ₹12,500, they can claim a rebate under Section 87The maximum rebate allowed is ₹2,500 for individuals with a taxable income up to ₹5 lakh. Therefore, in this case, the taxpayer would receive a full rebate of ₹2,500, effectively reducing their tax liability to ₹10,000. It is essential for taxpayers to keep accurate records of their income and deductions to ensure that they can correctly calculate their eligibility and the amount of rebate they can claim.

Maximizing Savings through Section 87A Tax Rebate

To maximize savings through the Section 87A tax rebate, individuals should focus on strategic financial planning and effective tax management. One of the most effective ways to do this is by ensuring that their total taxable income remains within the ₹5 lakh threshold. This can be achieved by utilizing various deductions available under different sections of the Income Tax Act.

For example, contributions to Public Provident Fund (PPF), National Pension Scheme (NPS), and life insurance premiums can significantly reduce taxable income. Moreover, taxpayers should also consider investing in tax-saving instruments that not only provide deductions but also yield returns over time. By carefully planning investments and expenses, individuals can optimize their financial portfolio while ensuring they remain eligible for the Section 87A rebate.

Additionally, keeping abreast of any changes in tax laws or limits set by the government can help taxpayers make informed decisions regarding their finances.

Tips for Claiming Section 87A Tax Rebate

| Metric | Details |

|---|---|

| Tax Rebate Name | US 87A Tax Rebate |

| Eligibility | Individual taxpayers meeting specific income criteria |

| Maximum Rebate Amount | Up to 1,200 |

| Income Limit | Adjusted Gross Income (AGI) up to 75,000 for single filers |

| Phase-out Range | 75,000 to 99,000 for single filers |

| Filing Status | Single, Married Filing Jointly, Head of Household |

| Claim Method | Filed with annual tax return using IRS Form 1040 |

| Purpose | Stimulate economic activity by providing direct financial relief |

| Year Introduced | 2020 |

Claiming the Section 87A tax rebate requires careful attention to detail and adherence to specific procedures outlined by the Income Tax Department. One of the first tips for claiming this rebate is to maintain comprehensive documentation of all income sources and deductions claimed throughout the financial year. This includes salary slips, bank statements, and receipts for any investments made in tax-saving instruments.

Another important tip is to file income tax returns (ITR) accurately and on time. The ITR form must reflect all relevant details regarding income and deductions to ensure that the rebate is processed smoothly. Taxpayers should also consider e-filing their returns, as this method often expedites processing times and reduces errors associated with manual submissions.

Additionally, consulting with a tax professional or financial advisor can provide valuable insights into maximizing rebates and ensuring compliance with tax regulations.

Impact of Section 87A Tax Rebate on Different Income Brackets

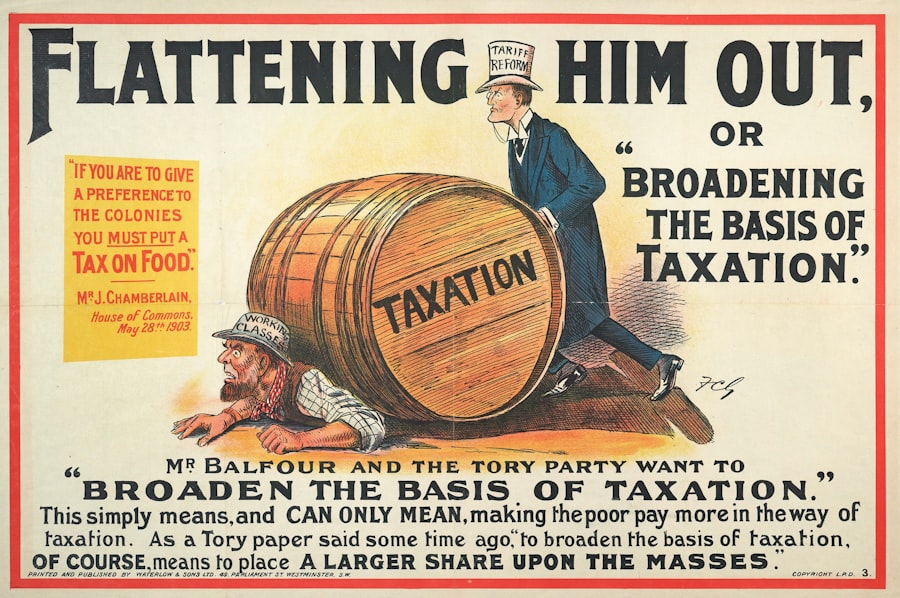

The impact of Section 87A tax rebate varies significantly across different income brackets. For individuals earning below ₹5 lakh, this rebate serves as a crucial financial relief mechanism, allowing them to retain more of their earnings and improve their standard of living. This demographic often includes first-time job holders and lower-middle-class families who may struggle with day-to-day expenses.

By reducing their tax burden, these individuals can allocate more funds towards essential needs such as education, healthcare, and housing. Conversely, for those earning above ₹5 lakh, the absence of this rebate means they face a higher tax liability without any relief measures. This creates a disparity in disposable income between lower-income earners who benefit from the rebate and those who do not.

The government’s intent behind Section 87A is to promote equity in taxation by providing relief to those who need it most while ensuring that higher earners contribute a fair share towards national revenue.

Common Mistakes to Avoid When Claiming Section 87A Tax Rebate

When claiming the Section 87A tax rebate, taxpayers often make several common mistakes that can lead to complications or disqualification from receiving the benefit. One prevalent error is miscalculating total taxable income by failing to account for all sources of income or incorrectly applying deductions. It is crucial for individuals to have a clear understanding of what constitutes taxable income and how various deductions impact their overall financial picture.

Another mistake involves neglecting to file income tax returns on time or submitting incomplete forms. Delays in filing can result in penalties or missed opportunities for claiming rebates altogether. Additionally, some taxpayers may overlook changes in tax laws or limits set by the government regarding eligibility for rebates.

Staying informed about these changes is essential for ensuring compliance and maximizing potential savings through available rebates.

Future Outlook for Section 87A Tax Rebate

The future outlook for Section 87A tax rebate appears promising as it continues to play a vital role in supporting lower-income taxpayers in India. Given the ongoing discussions around economic reforms and social welfare initiatives, it is likely that the government will reassess the thresholds and limits associated with this rebate periodically. As inflation rises and living costs increase, adjustments may be made to ensure that more individuals can benefit from this provision.

Moreover, there is potential for expanding the scope of Section 87A to include additional categories of taxpayers or increasing the maximum rebate amount available. Such changes would reflect a commitment by policymakers to address economic disparities and support those who are most vulnerable in society. As discussions around taxation evolve in response to changing economic conditions, taxpayers should remain vigilant and informed about any developments related to Section 87A that could impact their financial planning strategies in the future.