The Volunteer Income Tax Assistance (VITA) program is a federally-sponsored initiative administered by the Internal Revenue Service (IRS) that provides free tax preparation services to individuals and families earning $64,000 or less annually. The program operates through community-based sites including libraries, schools, shopping centers, and community centers across the United States. VITA volunteers complete IRS-certified training programs that cover federal tax law, ethics, and quality review processes.

Volunteers must pass competency tests and receive annual recertification to maintain their qualification to prepare returns. The program focuses on basic tax situations, including standard deductions, earned income tax credit, child tax credit, and education credits. The program serves approximately 3 million taxpayers annually and has prepared over 70 million tax returns since its inception in 1969.

VITA sites typically operate from January through April during tax season, with some locations offering extended hours and weekend availability. Services include electronic filing, direct deposit options, and multilingual assistance at select locations. The program also provides basic financial counseling and connects participants with other community resources when appropriate.

Key Takeaways

- Vita Tax Prep offers free tax preparation services for eligible individuals.

- It helps maximize your tax refund by ensuring accurate and thorough filing.

- Qualification is based on income limits and other eligibility criteria.

- Bringing necessary documents like ID, income statements, and prior tax returns is essential.

- Additional services include financial education and assistance with tax-related questions.

Benefits of using Vita Tax Prep

One of the primary benefits of utilizing Vita Tax Prep is the cost savings associated with free tax preparation services. For many individuals and families, especially those living paycheck to paycheck, the expense of hiring a professional tax preparer can be a significant burden. By offering these services at no cost, VITA alleviates financial stress and allows clients to allocate their limited resources toward other essential needs, such as housing, food, or healthcare.

In addition to cost savings, VITA provides access to knowledgeable volunteers who can offer personalized assistance tailored to each client’s unique financial situation. This one-on-one interaction fosters a supportive environment where clients can ask questions and gain clarity on various aspects of their tax returns. Furthermore, VITA volunteers are trained to identify potential tax credits and deductions that clients may not be aware of, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit.

By maximizing available credits, clients can potentially increase their refunds, providing them with additional financial relief.

How to qualify for Vita Tax Prep

Qualifying for Vita Tax Prep services is relatively straightforward, as the program is designed specifically for individuals and families with low to moderate incomes. Generally, the income threshold is set at $60,000 or less for the tax year in question, although this figure may vary slightly depending on local guidelines and specific VITA sites. Additionally, VITA services are available to individuals regardless of their immigration status, making it an inclusive option for many communities.

Beyond income limits, clients seeking assistance through VITA should also have a basic understanding of their financial situation. This includes being able to provide information about their income sources, such as wages from employment, self-employment income, or government benefits. While VITA volunteers are trained to assist with various tax scenarios, having a clear picture of one’s financial landscape can facilitate a smoother and more efficient tax preparation process.

What to bring to your Vita Tax Prep appointment

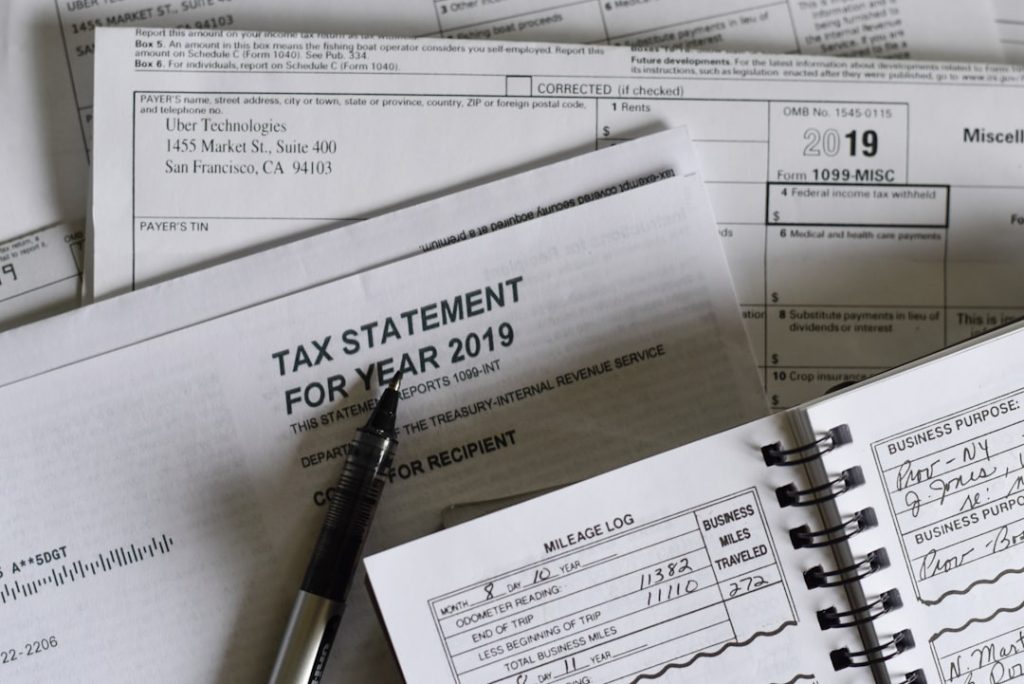

Preparing for a Vita Tax Prep appointment requires gathering specific documents that will help volunteers accurately complete your tax return. Essential items include proof of identity, such as a government-issued photo ID or Social Security card for each family member. This documentation is crucial for verifying identities and ensuring compliance with IRS regulations.

Additionally, clients should bring all relevant income statements, including W-2 forms from employers, 1099 forms for freelance or contract work, and any other documentation related to income sources. If applicable, clients should also gather records of any deductions or credits they wish to claim, such as receipts for childcare expenses or educational costs. Having these documents organized and readily available will not only expedite the process but also enhance the accuracy of the completed tax return.

How Vita Tax Prep maximizes your refund

| Metric | Value | Description |

|---|---|---|

| Number of VITA Sites | 9,000+ | Total VITA locations across the United States |

| Average Tax Returns Prepared | 200 per site | Average number of tax returns completed per VITA site annually |

| Volunteer Hours | 1.2 million+ | Total volunteer hours contributed to VITA programs annually |

| Income Eligibility | Up to 60,000 | Maximum household income to qualify for free VITA tax preparation |

| IRS Certification Levels | Basic, Advanced, Military | Certification levels required for VITA volunteers |

| Average Refund Amount | 3,000 | Average tax refund amount received by VITA clients |

| Free Services Offered | Tax preparation, E-filing, Tax counseling | Types of services provided at no cost through VITA |

Vita Tax Prep is designed not only to assist clients in filing their taxes but also to maximize their potential refunds through careful examination of available credits and deductions. Volunteers are trained to identify various tax benefits that clients may qualify for based on their financial circumstances. For instance, many low-income families may be eligible for the Earned Income Tax Credit (EITC), which can significantly increase their refund amount.

Moreover, VITA volunteers are adept at navigating the complexities of tax laws and regulations that pertain to specific situations. They can help clients understand how different deductions work—such as those related to education expenses or medical costs—and ensure that all eligible deductions are claimed. By taking the time to thoroughly review each client’s financial situation and educate them about potential benefits, VITA maximizes refunds while also fostering a sense of financial literacy among participants.

Other services offered by Vita Tax Prep

In addition to free tax preparation services, Vita Tax Prep often provides a range of complementary services aimed at enhancing financial literacy and stability within communities. Many VITA sites offer workshops and informational sessions on topics such as budgeting, saving strategies, and understanding credit scores. These educational components empower clients with knowledge that extends beyond tax season and encourages long-term financial health.

Furthermore, some VITA locations may collaborate with local organizations to provide additional resources such as access to financial counseling or assistance with applying for government benefits. This holistic approach not only addresses immediate tax needs but also supports clients in achieving broader financial goals. By integrating these services into the VITA framework, the program fosters a comprehensive support system for individuals and families striving for economic stability.

How to find a Vita Tax Prep location near you

Finding a Vita Tax Prep location is relatively easy due to the program’s extensive network across the United States. The IRS provides an online locator tool on its website where individuals can enter their zip code to find nearby VITA sites. This tool typically lists locations along with their operating hours and contact information, making it convenient for clients to plan their visits.

In addition to the online locator tool, many community organizations and local libraries often have information about VITA services available in their areas. These resources can be particularly helpful for individuals who may not have internet access or who prefer in-person assistance in locating a nearby site. It’s advisable for clients to call ahead and confirm availability, as some locations may operate on a first-come, first-served basis or require appointments during peak tax season.

Tips for preparing for your Vita Tax Prep appointment

To ensure a successful experience at your Vita Tax Prep appointment, preparation is key. Start by compiling all necessary documents well in advance of your appointment date. This includes income statements, proof of identity, and any relevant receipts or records related to deductions or credits you plan to claim.

Organizing these documents in a folder can help streamline the process and reduce stress on the day of your appointment. Additionally, consider making a list of questions you may have regarding your taxes or financial situation. This proactive approach allows you to engage more effectively with the volunteers assisting you and ensures that you leave your appointment with a clearer understanding of your tax return and any potential next steps.

Finally, arriving early can provide you with extra time to fill out any required forms and review your documents before meeting with a volunteer, ultimately leading to a more productive session.