Vita Tax Services, often referred to as VITA (Volunteer Income Tax Assistance), is a program designed to provide free tax preparation assistance to individuals and families with low to moderate incomes. Established by the Internal Revenue Service (IRS), VITA aims to ensure that those who may not have the resources to afford professional tax services can still receive quality assistance. The program is staffed by trained volunteers who are knowledgeable about tax laws and can help clients navigate the complexities of filing their taxes.

VITA services are typically offered during the tax season, from January through April, at various community locations, including libraries, community centers, and schools. The volunteers at VITA are not only trained in tax preparation but also in understanding the specific needs of the communities they serve. This means they are equipped to handle a variety of tax situations, including those involving earned income tax credits (EITC), child tax credits, and other relevant deductions.

The program is particularly beneficial for individuals who may be unfamiliar with tax filing processes or who have limited access to technology and resources. By providing free services, VITA helps alleviate the financial burden of tax preparation and ensures that eligible taxpayers can claim all the credits and deductions they qualify for.

Key Takeaways

- Vita Tax Services offers expert assistance to simplify the tax filing process.

- Utilizing Vita can help maximize refunds through common deductions and credits.

- Proper preparation before your appointment ensures a smooth and efficient experience.

- Filing accurate and timely taxes is crucial to avoid penalties and delays.

- Vita also provides valuable tax planning advice to support your financial future.

Benefits of Using Vita Tax Services

One of the primary benefits of utilizing Vita Tax Services is the cost savings associated with free tax preparation. For many individuals and families, hiring a professional tax preparer can be prohibitively expensive, especially for those with limited incomes. VITA eliminates this financial barrier, allowing clients to receive expert assistance without incurring any fees.

This is particularly advantageous for those who may be eligible for various tax credits that can significantly increase their refund but may not know how to claim them without professional help. In addition to cost savings, VITA provides a supportive environment where clients can ask questions and receive personalized assistance. The volunteers are trained to work with diverse populations, including non-English speakers and individuals with disabilities.

This inclusivity ensures that everyone has access to the information and support they need to file their taxes accurately. Furthermore, VITA locations often offer additional resources, such as financial literacy workshops and information on other community services, which can empower clients to make informed financial decisions beyond tax season.

How to Prepare for Your Vita Tax Services Appointment

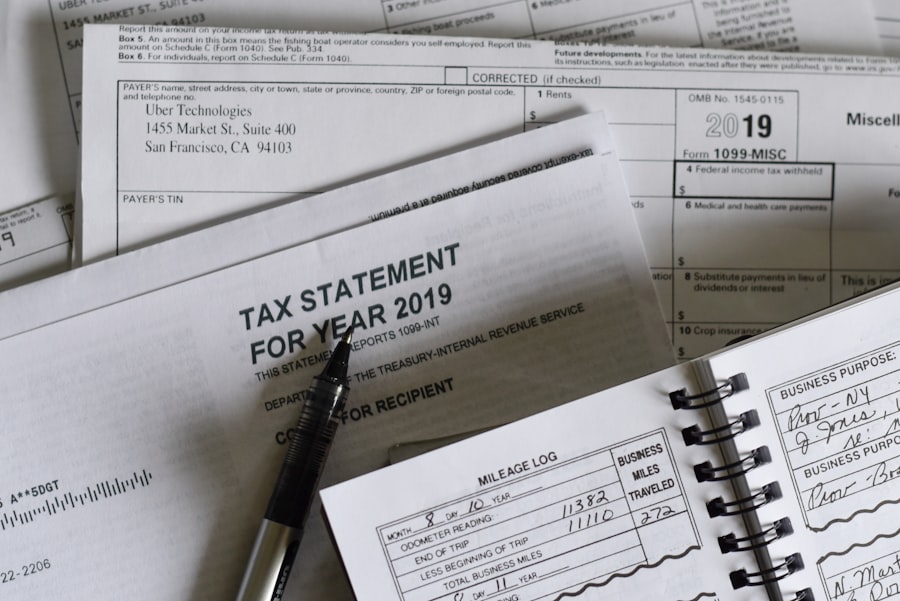

Preparing for your appointment with Vita Tax Services is crucial to ensure a smooth and efficient tax filing process. First and foremost, gather all necessary documentation before your visit. This includes your Social Security card or Individual Taxpayer Identification Number (ITIN), W-2 forms from employers, 1099 forms for any freelance or contract work, and any other income statements you may have received.

Additionally, if you are claiming deductions or credits, be sure to bring relevant documents such as receipts for medical expenses, childcare costs, or educational expenses. Another important aspect of preparation is understanding your financial situation. Take some time to review your income sources and any potential deductions you might qualify for.

If you have children or dependents, familiarize yourself with the child tax credit and earned income tax credit eligibility requirements. Being informed about your financial circumstances will not only help you communicate effectively with the volunteer preparers but also ensure that you maximize your potential refund. Lastly, consider making an appointment during off-peak hours to avoid long wait times and ensure you receive the attention you need.

Common Tax Deductions and Credits to Maximize Your Refund

When filing taxes, understanding common deductions and credits can significantly impact your refund amount. One of the most widely utilized credits is the Earned Income Tax Credit (EITC), which is designed to benefit low-to-moderate-income working individuals and families. The EITC can provide a substantial boost to your refund, especially if you have qualifying children.

The amount of the credit varies based on income level and number of dependents, making it essential for eligible taxpayers to claim it. Another important deduction is the Child Tax Credit (CTC), which allows parents or guardians to reduce their taxable income based on the number of qualifying children they have. For the tax year 2022, the CTC was expanded under certain provisions, allowing families to claim up to $2,000 per qualifying child under age 17.

Additionally, taxpayers may also be eligible for deductions related to education expenses, such as the American Opportunity Credit or Lifetime Learning Credit, which can help offset the costs of higher education. By being aware of these deductions and credits, taxpayers can ensure they are maximizing their refunds when utilizing Vita Tax Services.

Tips for Maximizing Your Refund with Vita Tax Services

| Service | Description | Average Processing Time | Customer Satisfaction Rate | Availability |

|---|---|---|---|---|

| Basic Tax Filing | Preparation and filing of federal and state tax returns for individuals with simple tax situations. | 1-2 hours | 95% | January – April |

| Advanced Tax Filing | Assistance with complex tax returns including self-employment, investments, and rental income. | 2-4 hours | 90% | January – April |

| Tax Counseling | Guidance on tax planning, credits, deductions, and IRS notices. | 30-60 minutes | 92% | Year-round |

| Electronic Filing | Fast and secure e-filing of tax returns directly to the IRS and state agencies. | Immediate submission | 98% | January – April |

| Refund Assistance | Help with tracking and receiving tax refunds efficiently. | Varies by IRS processing | 94% | January – April |

To maximize your refund while using Vita Tax Services, it is essential to approach the process with a proactive mindset. First, ensure that you are fully aware of all available credits and deductions that apply to your situation. This includes not only the EITC and CTC but also other potential deductions such as those for student loan interest or contributions to retirement accounts.

By being informed about what you may qualify for, you can provide accurate information during your appointment. Another effective strategy is to keep meticulous records throughout the year. Maintaining organized documentation of your income sources, expenses, and any relevant receipts will streamline the tax preparation process and reduce the likelihood of missing out on potential deductions.

Additionally, consider discussing your financial goals with the VITA volunteers during your appointment; they may offer insights into future tax planning strategies that could further enhance your financial situation in subsequent years.

The Importance of Filing Accurate and Timely Taxes

Filing accurate and timely taxes is crucial for several reasons. Firstly, submitting your tax return on time helps avoid penalties and interest charges that can accrue if you miss the deadline. The IRS imposes strict deadlines for filing returns, typically April 15th for most taxpayers.

Failing to meet this deadline can result in significant financial repercussions that could have been easily avoided by planning ahead and ensuring all necessary documentation is submitted promptly. Moreover, accurate filing is essential for ensuring that you receive any refunds or credits you are entitled to without delay. Errors in your tax return can lead to processing delays or even audits by the IRS, which can be time-consuming and stressful.

By utilizing services like Vita Tax Services, taxpayers can benefit from trained volunteers who help minimize errors and ensure compliance with current tax laws. This not only expedites the refund process but also provides peace of mind knowing that your taxes have been filed correctly.

How Vita Tax Services Can Help with Tax Planning for the Future

Vita Tax Services goes beyond just preparing annual tax returns; it also plays a vital role in helping clients plan for their financial futures. During appointments, volunteers often take the time to discuss clients’ long-term financial goals and how their current tax situation fits into those plans. This proactive approach allows individuals to make informed decisions about saving for retirement, investing in education, or purchasing a home.

Additionally, VITA volunteers can provide valuable insights into changes in tax laws that may affect future filings. For instance, if there are new credits or deductions available in upcoming years or adjustments in income thresholds for existing credits, being aware of these changes can help clients strategize their finances effectively. By fostering a relationship built on trust and knowledge-sharing, Vita Tax Services empowers clients not only during tax season but throughout their financial journeys.

Frequently Asked Questions about Vita Tax Services

Many individuals seeking assistance from Vita Tax Services often have questions regarding eligibility and what to expect during their appointments. One common inquiry is about income limits; VITA typically serves individuals and families with incomes below a certain threshold—often around $60,000—though this can vary by location. It’s important for potential clients to check with their local VITA site for specific eligibility criteria.

Another frequently asked question pertains to the types of tax situations VITA can handle. While VITA volunteers are trained in various aspects of tax preparation, there are limitations on more complex cases such as those involving business income or extensive investment portfolios. Clients are encouraged to inquire about their specific situations when scheduling an appointment to ensure they receive appropriate assistance.

Overall, understanding these aspects can help demystify the process and encourage more individuals to take advantage of this valuable service.