In the modern business landscape, the role of accounting system software has evolved significantly, becoming an indispensable tool for organizations of all sizes. This software encompasses a range of applications designed to manage financial transactions, streamline accounting processes, and provide insights into a company’s financial health. From small startups to large corporations, the adoption of accounting software has transformed how businesses handle their finances, enabling them to operate more efficiently and make informed decisions based on real-time data.

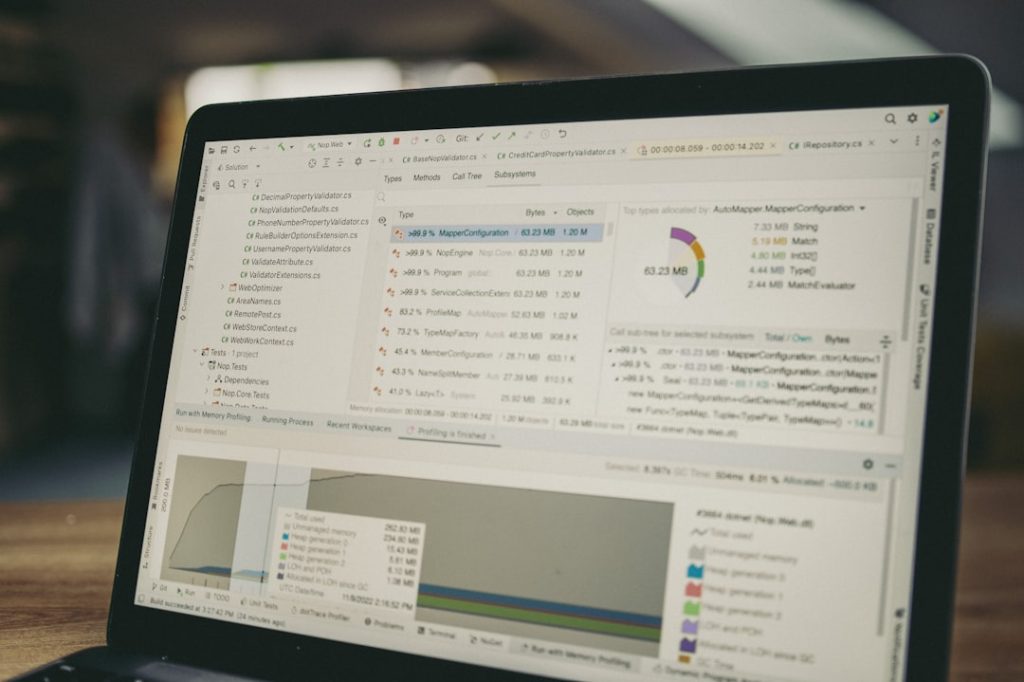

The advent of technology has led to the development of sophisticated accounting systems that not only automate routine tasks but also enhance accuracy and compliance with regulatory standards. These systems can handle various functions, including invoicing, payroll processing, tax calculations, and financial reporting. As businesses increasingly rely on data-driven strategies, the importance of robust accounting software cannot be overstated.

It serves as the backbone of financial management, allowing organizations to track their performance and plan for future growth.

Key Takeaways

- Accounting system software streamlines financial management for businesses.

- Choosing the right software depends on business size, needs, and integration capabilities.

- Customization and proper setup are crucial for optimal software performance.

- Integration with other business tools enhances workflow and data accuracy.

- Automating processes and analyzing data improve efficiency and financial decision-making.

Benefits of Using Accounting System Software

One of the primary advantages of utilizing accounting system software is the significant reduction in manual errors. Traditional accounting methods often involve extensive paperwork and manual data entry, which can lead to inaccuracies and discrepancies. By automating these processes, accounting software minimizes the risk of human error, ensuring that financial records are precise and reliable.

This accuracy is crucial for maintaining trust with stakeholders and complying with financial regulations. Moreover, accounting system software enhances efficiency by streamlining workflows. Tasks that once took hours or even days can now be completed in a fraction of the time.

For instance, generating invoices or processing payroll can be accomplished with just a few clicks. This efficiency not only saves time but also allows finance teams to focus on more strategic activities, such as financial analysis and forecasting. Additionally, many accounting systems offer features like real-time reporting and dashboards, providing businesses with immediate access to their financial data and enabling quicker decision-making.

How to Choose the Right Accounting System Software for Your Business

Selecting the appropriate accounting system software for your business requires careful consideration of several factors. First and foremost, it is essential to assess your specific needs and requirements. Different businesses have varying complexities in their financial operations; thus, a one-size-fits-all approach may not be effective.

For example, a small retail business may require basic invoicing and inventory management features, while a larger enterprise might need advanced functionalities such as multi-currency support and comprehensive financial reporting. Another critical aspect to consider is scalability. As your business grows, your accounting software should be able to accommodate increased transaction volumes and additional users without compromising performance.

It is advisable to choose a solution that offers modular features or can be easily upgraded to meet future demands. Additionally, evaluating the software’s user interface and ease of use is vital; a complicated system can hinder productivity and lead to frustration among staff members.

Setting Up and Customizing Your Accounting System Software

Once you have selected the right accounting system software, the next step is setting it up effectively. This process typically involves importing existing financial data, configuring settings according to your business structure, and establishing user roles and permissions. Many software providers offer guided setup processes or customer support to assist businesses in this phase.

It is crucial to ensure that all relevant data is accurately migrated to avoid discrepancies in financial reporting. Customization is another key component of setting up your accounting system software. Tailoring the software to fit your business processes can significantly enhance its effectiveness.

For instance, you may want to customize invoice templates to reflect your brand identity or set up specific categories for expense tracking that align with your operational needs. Additionally, configuring automated workflows for recurring transactions can save time and reduce manual intervention, further streamlining your accounting processes.

Integrating Accounting System Software with Other Business Tools

| Software Name | Key Features | Pricing Model | Target Users | Integration Options | Customer Rating (out of 5) |

|---|---|---|---|---|---|

| QuickBooks Online | Invoicing, Expense Tracking, Payroll, Tax Filing | Subscription-based | Small to Medium Businesses | Bank Feeds, Payment Gateways, CRM | 4.5 |

| FreshBooks | Time Tracking, Invoicing, Expense Management, Reporting | Subscription-based | Freelancers, Small Businesses | Payment Processors, Project Management Tools | 4.3 |

| Xero | Bank Reconciliation, Inventory, Payroll, Multi-currency | Subscription-based | Small to Medium Businesses | CRM, Payment Gateways, Inventory Systems | 4.4 |

| Zoho Books | Invoicing, Expense Tracking, Project Billing, Tax Compliance | Subscription-based | Small Businesses | Zoho Suite, Payment Gateways, CRM | 4.2 |

| Sage 50cloud | Inventory Management, Payroll, Invoicing, Reporting | One-time + Subscription | Small to Medium Businesses | Microsoft Office, Payment Processors | 4.0 |

To maximize the benefits of accounting system software, integration with other business tools is essential. Many organizations utilize various applications for customer relationship management (CRM), inventory management, project management, and e-commerce platforms. By integrating these systems with your accounting software, you can create a seamless flow of information across departments, reducing data silos and enhancing collaboration.

For example, integrating your accounting software with a CRM system allows for automatic updates of customer invoices based on sales activities. This integration not only saves time but also ensures that financial records are always up-to-date. Similarly, linking inventory management systems with accounting software can provide real-time insights into stock levels and cost of goods sold, facilitating better inventory control and financial planning.

The ability to connect various tools enhances overall operational efficiency and provides a holistic view of your business’s performance.

Automating Financial Processes with Accounting System Software

Automation is one of the most transformative features of modern accounting system software. By automating repetitive financial tasks, businesses can significantly reduce the time spent on manual processes while increasing accuracy. Common areas for automation include invoicing, expense tracking, payroll processing, and bank reconciliations.

For instance, automated invoicing allows businesses to generate and send invoices based on predefined schedules or triggers, ensuring timely billing without manual intervention. Furthermore, automation can enhance compliance by ensuring that financial records are maintained consistently according to regulatory standards. Many accounting systems come equipped with built-in compliance checks that automatically flag discrepancies or potential issues before they escalate into significant problems.

This proactive approach not only saves time but also mitigates risks associated with non-compliance.

Managing and Analyzing Financial Data with Accounting System Software

Effective management and analysis of financial data are critical for informed decision-making within any organization. Accounting system software provides powerful tools for tracking income and expenses, generating financial statements, and conducting variance analysis. With features like customizable reports and dashboards, businesses can gain insights into their financial performance at a glance.

For example, a company can analyze its cash flow trends over time by generating cash flow statements directly from the software. This analysis helps identify periods of surplus or deficit, enabling proactive cash management strategies. Additionally, many accounting systems offer forecasting tools that utilize historical data to project future financial performance.

By leveraging these analytical capabilities, businesses can make strategic decisions regarding budgeting, investments, and resource allocation.

Tips for Maximizing the Efficiency of Your Accounting System Software

To fully leverage the capabilities of your accounting system software, it is essential to adopt best practices that enhance its efficiency. Regularly updating the software ensures that you benefit from the latest features and security enhancements provided by the vendor. Many providers release updates that include new functionalities or improvements based on user feedback; staying current allows you to take advantage of these advancements.

Training staff members on how to use the software effectively is another critical factor in maximizing efficiency. Providing comprehensive training sessions can empower employees to utilize all available features confidently, reducing reliance on external support for routine tasks. Additionally, establishing clear protocols for data entry and record-keeping can help maintain consistency across the organization.

Utilizing integrations with other business tools can further enhance efficiency by creating a cohesive ecosystem where data flows seamlessly between applications. Regularly reviewing your processes and identifying areas for improvement can also lead to increased productivity over time. By fostering a culture of continuous improvement and leveraging technology effectively, businesses can optimize their accounting practices and drive overall success in their financial management efforts.