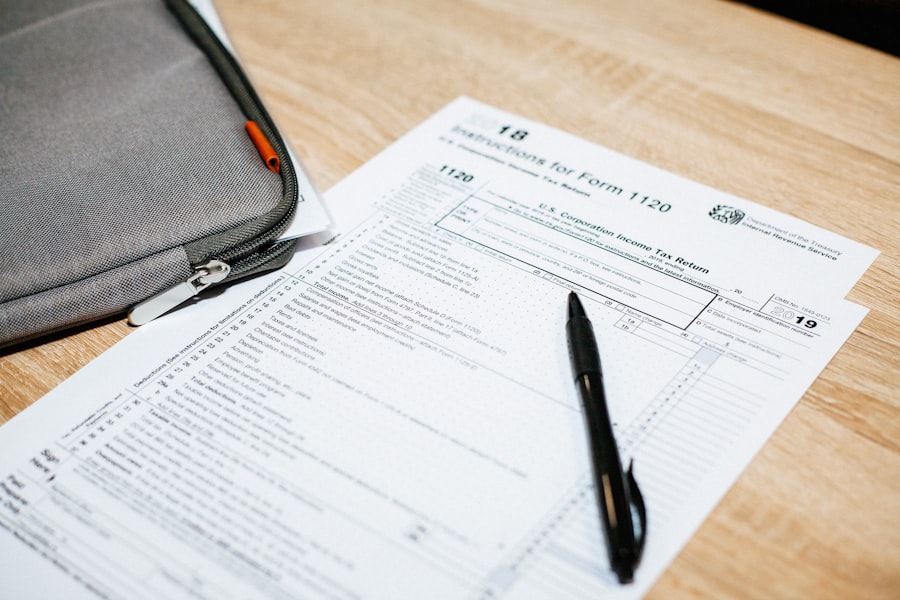

The tax preparation industry has experienced substantial changes in recent years due to technological advancements and widespread internet adoption. Online tax preparation services have become a viable alternative to traditional in-person filing methods, enabling taxpayers to complete and submit their returns remotely. This technological shift has streamlined the filing process and expanded access to tax preparation tools for a wider range of users.

Electronic filing systems allow taxpayers to complete tax forms, perform calculations, and submit returns digitally. Online tax preparation platforms typically feature user-friendly interfaces with guided filing processes. These systems accommodate users with different levels of tax expertise through various support features.

Beginning filers can access instructional materials and frequently asked questions, while experienced users can utilize advanced functionalities for complex financial circumstances. The availability of online tax preparation tools has increased accessibility to tax filing services, allowing more individuals to complete their returns independently without requiring professional tax preparation services.

Key Takeaways

- Online tax preparation offers a convenient and efficient way to file taxes from home.

- Selecting the right software depends on your tax situation and desired features.

- Maximizing deductions and credits can significantly reduce your tax liability.

- Staying informed about current tax laws ensures accurate and compliant filings.

- Protecting personal information and using electronic filing enhances security and speed.

Choosing the Right Online Tax Prep Software

Selecting the appropriate online tax preparation software is crucial for ensuring a smooth filing experience. With numerous options available, it is essential to consider several factors before making a decision. One of the primary considerations should be the complexity of your tax situation.

For example, if you are a freelancer or a small business owner with multiple income streams, you may require software that offers advanced features such as profit and loss statements, expense tracking, and self-employment tax calculations. Conversely, if your tax situation is straightforward, a basic version of tax software may suffice. Another important aspect to evaluate is the software’s compatibility with your financial documents.

Many online tax preparation tools allow users to import data directly from financial institutions or previous tax returns, which can save time and reduce errors. Additionally, consider the level of customer support provided by the software company. Some platforms offer live chat assistance or phone support, while others may rely solely on email communication.

Reading user reviews and comparing features can help you make an informed choice that aligns with your specific needs.

Maximizing Deductions and Credits

One of the most significant advantages of online tax preparation is the ability to maximize deductions and credits, which can substantially reduce your overall tax liability. Tax deductions lower your taxable income, while credits directly reduce the amount of tax owed. Understanding which deductions and credits you qualify for is essential in optimizing your tax return.

For instance, if you are a homeowner, you may be eligible for deductions related to mortgage interest and property taxes. Similarly, students can benefit from education-related credits such as the American Opportunity Credit or the Lifetime Learning Credit. Online tax preparation software often includes built-in tools that help identify potential deductions and credits based on the information you provide.

These tools may prompt you with questions about your financial situation, ensuring that you do not overlook any opportunities for savings. For example, if you have made charitable contributions throughout the year, the software will guide you through documenting these donations to claim the appropriate deduction. By leveraging these features effectively, taxpayers can significantly enhance their refunds or minimize their tax bills.

Understanding Tax Laws and Regulations

Navigating the complexities of tax laws and regulations can be daunting for many individuals. The U.S. tax code is extensive and frequently updated, making it essential for taxpayers to stay informed about changes that may impact their filings.

Online tax preparation platforms often incorporate the latest tax law updates into their systems, ensuring that users are compliant with current regulations. This integration helps mitigate the risk of errors that could lead to audits or penalties. Moreover, understanding specific provisions within the tax code can empower taxpayers to make informed decisions regarding their finances.

For instance, knowing about changes in capital gains tax rates or new deductions for remote workers can influence investment strategies or employment choices. Many online platforms provide educational resources such as articles, webinars, and FAQs that explain these laws in layman’s terms. By taking advantage of these resources, taxpayers can enhance their understanding of how various regulations apply to their unique situations.

Filing Your Taxes Electronically

| Tax Preparation Service | Ease of Use | Accuracy Guarantee | Customer Support | Price Range | Best For |

|---|---|---|---|---|---|

| TurboTax | 9/10 | 100% Accuracy Guarantee | 24/7 Live Chat & Phone | Free – Premium | All Tax Situations |

| H&R Block | 8.5/10 | 100% Accuracy Guarantee | In-Person & Online Support | Free – Premium | In-Person Assistance |

| TaxAct | 8/10 | 100% Accuracy Guarantee | Email & Phone Support | Free – Deluxe | Budget-Friendly |

| Credit Karma Tax | 7.5/10 | 100% Accuracy Guarantee | Email Support | Free | Simple Returns |

| FreeTaxUSA | 7/10 | 100% Accuracy Guarantee | Email & Chat Support | Free – Deluxe | Federal Returns |

Filing taxes electronically has become increasingly popular due to its speed and efficiency compared to traditional paper filing methods. The IRS encourages electronic filing (e-filing) as it reduces processing times and minimizes errors associated with manual data entry. When using online tax preparation software, e-filing is typically integrated into the process, allowing users to submit their returns directly to the IRS with just a few clicks.

One of the key benefits of e-filing is the ability to receive your refund faster than with paper filing. Taxpayers who opt for direct deposit can expect their refunds within days rather than weeks. Additionally, e-filing provides immediate confirmation from the IRS that your return has been received, offering peace of mind that your taxes have been filed on time.

Many online platforms also allow users to track the status of their refunds in real-time, providing transparency throughout the process.

Utilizing Tax Prep Support and Assistance

While online tax preparation software is designed to be user-friendly, some individuals may still encounter challenges during the filing process. This is where utilizing support and assistance becomes invaluable. Many online platforms offer various forms of support, including live chat options, phone consultations with tax professionals, and extensive knowledge bases filled with articles and guides.

For example, if you find yourself confused about how to report a specific type of income or how to handle a unique deduction situation, reaching out for assistance can clarify these issues. Some platforms even provide access to certified public accountants (CPAs) or enrolled agents who can offer personalized advice tailored to your circumstances. This level of support can be particularly beneficial for those with complex financial situations or who are navigating significant life changes such as marriage or homeownership.

Safeguarding Your Personal Information

As online tax preparation involves sharing sensitive personal information such as Social Security numbers and financial details, safeguarding this data is paramount. Reputable online tax software companies implement robust security measures to protect user information from cyber threats. These measures often include encryption protocols, secure servers, and multi-factor authentication processes that add an extra layer of security.

However, users must also take proactive steps to protect their information when using online platforms. This includes creating strong passwords that combine letters, numbers, and special characters and avoiding public Wi-Fi networks when accessing sensitive information. Additionally, regularly monitoring your financial accounts for any unauthorized transactions can help detect potential identity theft early on.

By being vigilant about security practices, taxpayers can confidently navigate online tax preparation without compromising their personal data.

Tips for Planning for Next Year’s Taxes

Effective tax planning is an ongoing process that extends beyond the annual filing deadline. To minimize stress during tax season and maximize potential savings in future years, individuals should adopt proactive strategies throughout the year. One essential tip is to maintain organized records of all financial transactions, including income sources, expenses, and receipts for deductible items.

Utilizing digital tools such as expense tracking apps can streamline this process and ensure that no important documentation is overlooked. Another critical aspect of planning for next year’s taxes involves staying informed about potential changes in tax laws that could affect your financial situation. Regularly reviewing IRS announcements or subscribing to newsletters from reputable financial organizations can provide valuable insights into upcoming changes in deductions or credits.

Additionally, consider consulting with a tax professional periodically throughout the year to discuss any significant life changes—such as marriage, divorce, or retirement—that may impact your tax strategy moving forward. By implementing these strategies and leveraging online resources effectively, taxpayers can navigate the complexities of tax preparation with confidence and ease while maximizing their financial outcomes year after year.