The concept of a uniform tax refund is rooted in the principle of equitable taxation, where taxpayers receive a refund that reflects their contributions to the tax system. This refund is typically issued by government entities to individuals or businesses that have overpaid their taxes during a given fiscal year. The uniformity aspect refers to the standardized approach in calculating these refunds, ensuring that all eligible taxpayers receive a fair and consistent amount based on their tax filings.

This system is designed to promote fairness and transparency in the tax process, allowing taxpayers to reclaim funds that they have contributed beyond their actual tax liabilities. In many jurisdictions, uniform tax refunds are not merely a bureaucratic formality; they serve as a vital mechanism for stimulating economic activity. When taxpayers receive refunds, they often reinvest this money into the economy through spending or saving, which can lead to increased consumer confidence and economic growth.

For instance, during times of economic downturn, uniform tax refunds can provide much-needed financial relief to households, enabling them to cover essential expenses or invest in local businesses. Understanding the nuances of how these refunds are calculated and distributed is crucial for taxpayers who wish to navigate the complexities of the tax system effectively.

Key Takeaways

- Uniform Tax Refund helps taxpayers recover overpaid uniform-related expenses.

- Eligibility depends on specific criteria such as employment status and uniform requirements.

- Applying requires submitting proper documentation and following designated procedures.

- Avoid common errors like missing deadlines or incomplete forms to ensure successful refunds.

- Consider professional advice to optimize refund amounts and manage funds effectively.

Eligibility for Uniform Tax Refund

Eligibility for a uniform tax refund typically hinges on several key factors, including income level, filing status, and the specific tax credits or deductions claimed during the tax year. Most jurisdictions require taxpayers to file their returns accurately and on time to qualify for any potential refunds. For instance, individuals who earn below a certain income threshold may be eligible for additional credits that can enhance their refund amounts.

Additionally, those who have experienced significant life changes—such as marriage, divorce, or the birth of a child—may also find themselves eligible for different tax benefits that could influence their refund. Moreover, certain tax jurisdictions may impose specific requirements regarding residency or employment status. For example, some states offer uniform tax refunds only to residents who have lived within the state for a minimum period during the tax year.

Similarly, taxpayers who are self-employed or own businesses may need to meet additional criteria related to their business income and expenses. Understanding these eligibility requirements is essential for taxpayers to ensure they maximize their potential refunds and avoid any pitfalls that could lead to disqualification.

How to Apply for Uniform Tax Refund

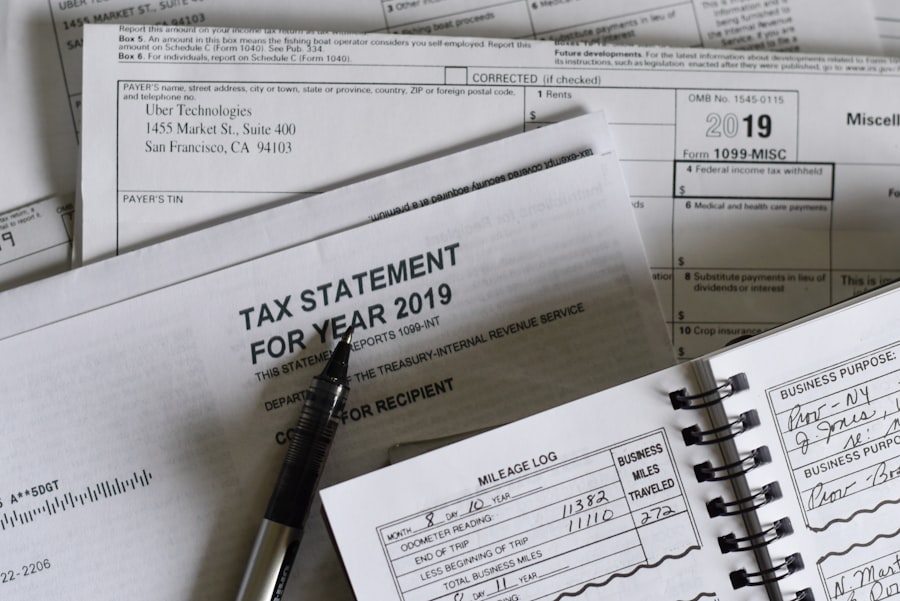

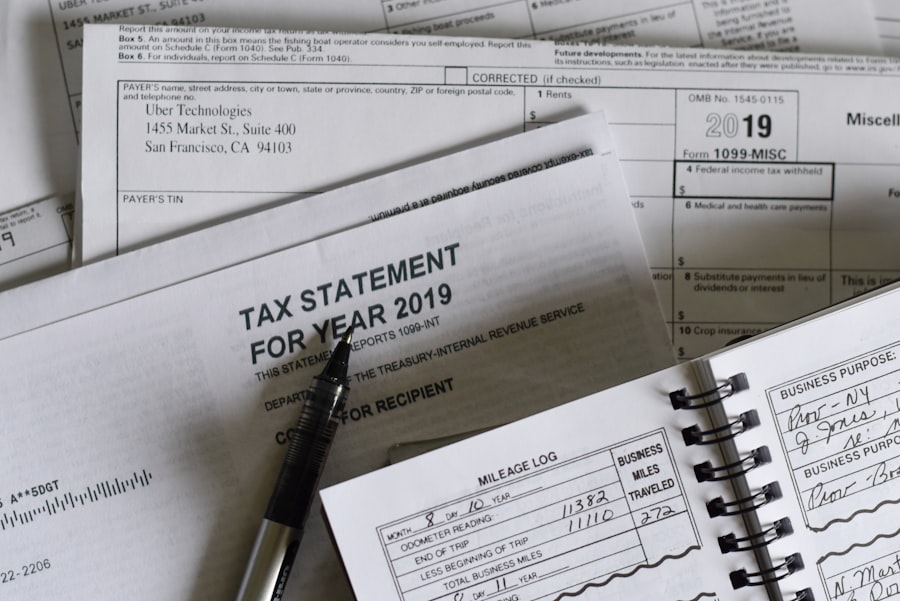

Applying for a uniform tax refund generally involves completing the appropriate tax forms and submitting them to the relevant tax authority. The process begins with gathering all necessary documentation, including W-2 forms, 1099s, and any receipts for deductible expenses. Taxpayers must ensure that they accurately report their income and claim any eligible deductions or credits that could increase their refund amount.

Many jurisdictions provide online platforms where taxpayers can file their returns electronically, streamlining the application process and reducing the likelihood of errors. Once the application is submitted, it is crucial to keep track of its status. Most tax authorities offer online tools that allow taxpayers to check the progress of their refund claims.

In some cases, taxpayers may need to respond to inquiries from the tax authority if there are discrepancies or additional information required. Being proactive in addressing any issues can help expedite the refund process. Additionally, understanding the typical timelines for processing refunds can help set realistic expectations regarding when funds will be received.

Maximizing Your Returns with Uniform Tax Refund

To maximize returns from a uniform tax refund, taxpayers should take a strategic approach when preparing their tax filings. This includes being aware of all available deductions and credits that can significantly impact the final refund amount. For example, taxpayers should consider contributions to retirement accounts, educational expenses, and medical costs that may qualify for deductions.

Utilizing tax preparation software or consulting with a tax professional can help identify these opportunities and ensure that no potential savings are overlooked. Furthermore, timing can play a critical role in maximizing refunds. Taxpayers should be mindful of deadlines for filing returns and claiming credits.

For instance, some credits may only be available for a limited time or may require specific actions to be taken within the tax year. By planning ahead and being organized throughout the year—such as keeping meticulous records of expenses and income—taxpayers can position themselves to receive the highest possible refund when they file their taxes.

Common Mistakes to Avoid When Applying for Uniform Tax Refund

| Metric | Description | Value | Unit |

|---|---|---|---|

| Average Refund Amount | Mean amount refunded to taxpayers under uniform tax refund policy | 1200 | Currency Units |

| Refund Processing Time | Average time taken to process a uniform tax refund | 15 | Days |

| Percentage of Eligible Taxpayers | Share of taxpayers eligible for uniform tax refund | 75 | Percent |

| Total Refunds Issued | Number of uniform tax refunds issued in the last fiscal year | 1,500,000 | Count |

| Refund Claim Rate | Percentage of eligible taxpayers who claimed the refund | 68 | Percent |

When applying for a uniform tax refund, several common mistakes can hinder the process or result in reduced refunds. One prevalent error is failing to report all sources of income accurately. Taxpayers sometimes overlook freelance work or side jobs that generate additional income, which can lead to discrepancies in their filings and potential penalties from tax authorities.

It is essential to maintain comprehensive records of all income sources throughout the year to avoid this pitfall. Another frequent mistake involves neglecting to claim eligible deductions or credits due to lack of awareness or misunderstanding of the requirements. For instance, many taxpayers are unaware of specific credits available for education expenses or energy-efficient home improvements.

Failing to take advantage of these opportunities can result in significantly lower refunds than what could have been obtained. Therefore, staying informed about current tax laws and seeking guidance when needed can help mitigate these common errors.

Tips for Managing Your Uniform Tax Refund

Once taxpayers receive their uniform tax refunds, effective management of these funds is crucial for maximizing their benefits. One key strategy is to create a budget that allocates the refund towards essential expenses or savings goals. For instance, using a portion of the refund to pay off high-interest debt can provide immediate financial relief and improve overall financial health.

Alternatively, setting aside funds for an emergency savings account can help build financial resilience against unforeseen circumstances. Additionally, considering long-term financial goals when managing a tax refund can lead to more significant benefits over time. Taxpayers might explore options such as investing in retirement accounts or contributing to education savings plans for children.

These investments not only provide immediate benefits but also contribute to long-term wealth accumulation and financial security. By taking a thoughtful approach to managing their refunds, taxpayers can ensure that they make the most out of this financial windfall.

Investing Your Uniform Tax Refund Wisely

Investing a uniform tax refund wisely can yield substantial returns over time, transforming what might be seen as a one-time financial boost into a long-term asset. One popular option is contributing to retirement accounts such as an Individual Retirement Account (IRA) or a 401(k). These accounts offer tax advantages that can enhance overall savings growth while providing a safety net for future financial needs.

For example, contributions made to traditional IRAs may be tax-deductible, allowing individuals to reduce their taxable income while simultaneously saving for retirement. Another avenue for investment is purchasing stocks or mutual funds. By allocating a portion of the refund towards investments in diversified portfolios, taxpayers can potentially benefit from market growth over time.

It’s essential to conduct thorough research or consult with financial advisors before making investment decisions to ensure alignment with personal risk tolerance and financial goals. Additionally, considering real estate investments—whether through direct property purchases or Real Estate Investment Trusts (REITs)—can also provide opportunities for passive income and capital appreciation.

Seeking Professional Help for Uniform Tax Refund

Navigating the complexities of uniform tax refunds can be daunting, particularly for individuals with unique financial situations or those unfamiliar with tax regulations. Seeking professional help from certified public accountants (CPAs) or tax advisors can provide invaluable insights and assistance throughout the process. These professionals possess extensive knowledge of current tax laws and regulations, enabling them to identify potential deductions and credits that taxpayers may overlook.

Moreover, engaging with a tax professional can help ensure compliance with all filing requirements and deadlines, reducing the risk of errors that could lead to audits or penalties. They can also offer personalized strategies tailored to individual financial circumstances, helping clients maximize their refunds while planning for future tax implications. In an increasingly complex financial landscape, leveraging professional expertise can empower taxpayers to make informed decisions regarding their uniform tax refunds and overall financial health.